Agreement to provide insurance form PDF Artikels the crucial aspects of insurance agreements. Understanding the structure, legal implications, and proper completion procedures is essential for both providers and recipients of insurance coverage. This comprehensive guide delves into the intricacies of these forms, addressing common issues and offering practical solutions.

The document details the various sections of the agreement, emphasizing the significance of accurate information. It examines the legal ramifications of incomplete or inaccurate entries, emphasizing compliance with regulations. Furthermore, the guide details the steps for completing the form, including electronic and manual submissions. It highlights the importance of retaining records and preserving confidentiality.

Form Structure and Content

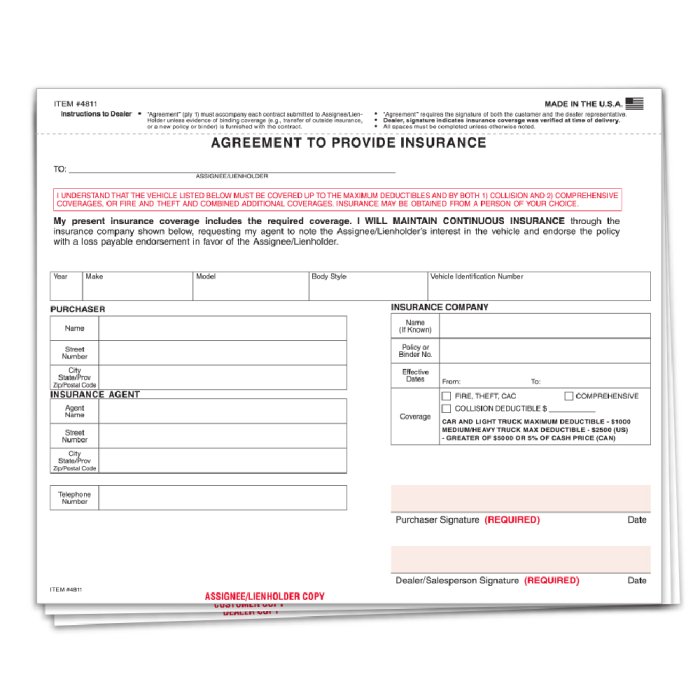

An agreement to provide insurance form is a crucial document outlining the terms and conditions of an insurance policy. Its structure is meticulously designed to ensure clarity, completeness, and enforceability. This form serves as a legally binding contract between the insurer and the insured, specifying the scope of coverage, responsibilities, and limitations.The form’s structure is designed to be comprehensive and unambiguous, allowing both parties to understand their obligations and rights.

It carefully details the specifics of the insurance agreement, preventing future disputes and misunderstandings.

Typical Sections

The typical insurance agreement form contains several key sections. Each section is designed to capture specific information pertinent to the insurance policy.

- Insured Information: This section collects essential details about the individual or entity being insured. This typically includes full name, address, date of birth, contact information, and any other relevant identifiers.

- Policy Details: This section specifies the type of insurance, the policy number, the effective and expiration dates, and the premium amount. Policy details also specify the coverage period and geographic limitations.

- Coverage Details: This section is paramount to defining the scope of the insurance. It Artikels the specific perils covered, the amount of coverage for each peril, and any exclusions. For example, it would define whether coverage extends to specific locations or activities. This section is essential for ensuring the policyholder understands what is and isn’t covered.

- Payment Information: This section details the payment terms, frequency, and method of premium payments. It often includes information on due dates and penalties for late payments.

- Declarations: These statements confirm the accuracy of the information provided by the insured and their understanding of the terms and conditions.

- Signatures and Acknowledgements: This section ensures the agreement is legally binding, requiring both parties to sign and date the document, confirming their acceptance of the terms.

Information Required

The form necessitates various types of information. This includes personal details of the insured, policy specifics, and coverage particulars. The type of information required depends on the specific insurance policy.

- Personal Details: Full name, address, date of birth, contact information, social security number (in some cases), and occupation are common examples. These details help identify the insured and manage policy-related communications.

- Policy Details: Policy number, effective date, expiration date, premium amount, and type of coverage are included in this section. This information helps identify the policy and track its status.

- Coverage Details: Specific coverage amounts, perils covered (e.g., fire, theft), and exclusions (e.g., pre-existing conditions) are critical to outlining the extent of the insurance coverage.

Presentation of Information

Different methods can be used to present information on the form.

- Text Fields: Used for entering textual data like names, addresses, and policy numbers.

- Checkboxes: Ideal for selecting options or agreeing to terms and conditions.

- Drop-down Menus: Useful for predefined choices, such as policy types or coverage options.

Form Structure Table

| Section | Data Type | Description |

|---|---|---|

| Insured Information | Text, Date | Personal details of the insured. |

| Policy Details | Text, Date, Number | Policy specifics and effective dates. |

| Coverage Details | Text, Number, Checkboxes | Details of what is covered and excluded. |

| Payment Information | Text, Date, Number | Payment terms and methods. |

| Declarations | Text, Checkboxes | Statements confirming accuracy and understanding. |

| Signatures and Acknowledgements | Signatures, Dates | Legal confirmation of agreement. |

Common Clauses and Provisions, Agreement to provide insurance form pdf

| Clause | Description | Legal Implication |

|---|---|---|

| Exclusions | Specific events or situations not covered by the policy. | Limits liability of the insurer. |

| Policy Limits | Maximum amount the insurer will pay for a covered claim. | Defines financial responsibility of the insurer. |

| Conditions | Specific requirements or obligations of the insured. | Artikels the responsibilities of both parties. |

| Waiver of Subrogation | Waives the insurer’s right to recover from a third party. | Reduces the insurer’s ability to seek recovery from a negligent party. |

| Cancellation Provisions | Conditions under which the policy can be cancelled by either party. | Specifies the procedures and rights of the parties. |

Legal Considerations

This section Artikels the critical legal implications of the insurance agreement. Understanding these aspects ensures a legally sound and enforceable contract, protecting both the insurance provider and the policyholder. Accurate and complete information is paramount to prevent future disputes and maintain the integrity of the insurance agreement.Accurate and complete information is vital to establishing a legally sound agreement.

Omissions or inaccuracies can lead to the agreement being deemed invalid or unenforceable. Furthermore, the form’s clauses and provisions must align with applicable laws and regulations.

Legal Implications of Form Clauses and Provisions

The clauses and provisions of the insurance agreement must be clear, concise, and unambiguous to avoid misinterpretations. Ambiguous language can lead to legal challenges and disputes over the agreement’s terms. Each clause should specify the rights and obligations of both the insurance provider and the policyholder.

Importance of Accuracy and Completeness

Accurate and complete information is essential for the validity and enforceability of the insurance agreement. Incomplete or inaccurate information can invalidate the agreement or create loopholes that can be exploited by either party. This is critical to ensure the agreement aligns with legal requirements.

Potential Legal Issues from Incomplete or Inaccurate Information

Examples of potential legal issues include disputes over coverage, claim denials, and the inability to enforce the agreement’s terms. An insurance company might deny a claim if the insured provided inaccurate information about their pre-existing conditions, impacting the policyholder’s ability to receive benefits. Similarly, if the policyholder misrepresents the value of the insured property, it could lead to disputes over the amount of compensation paid in the event of a loss.

The validity of the contract can be jeopardized by missing or misleading information about the risk being insured.

Compliance with Relevant Regulations

Adherence to relevant regulations is crucial for ensuring the agreement’s legality and validity. Compliance with specific regulations varies by jurisdiction and type of insurance. Insurance providers must comply with state-specific insurance codes and federal regulations, such as the Fair Credit Reporting Act. Failure to comply with these regulations can lead to penalties, fines, and legal action. Regulations vary and may require specific disclosures and compliance procedures to ensure fair practices and protect the interests of all parties.

Responsibilities of the Insurance Provider

The insurance provider is responsible for providing accurate and complete information about the insurance policy’s terms and conditions. They must ensure the policy complies with all applicable laws and regulations. This includes clearly communicating coverage details, exclusions, and any limitations to the policyholder. A clear and transparent policy document outlining the responsibilities of both parties is essential.

Responsibilities of the Policyholder

The policyholder is responsible for providing accurate and complete information about the insured risk. They must comply with the terms and conditions of the policy. This includes promptly reporting any incidents or claims as required by the policy. Transparency and honesty are crucial for both parties to ensure the validity and enforceability of the contract.

Form Completion and Submission

Completing and submitting this insurance agreement form accurately and promptly is crucial for the validity and effectiveness of the agreement. Proper procedures ensure the insurance coverage is initiated as intended. This section details the steps involved in completing the form electronically and manually, as well as the methods for submitting the completed document.The following sections provide clear instructions for each stage of the process, from completing the form to submitting it for processing.

Adhering to these guidelines minimizes potential errors and ensures a smooth insurance application process.

Electronic Form Completion

Electronic forms offer a convenient and efficient way to complete the insurance agreement. Use the provided online portal to access the form. Navigate through the form fields, ensuring accurate input of all required information. Carefully review each section before proceeding. Verify the accuracy of the entered data, especially personal details and policy specifics.

Use the form’s built-in validation tools to identify and correct potential errors. Utilize the help functions within the portal for guidance on specific fields if needed.

Manual Form Completion and Signing

In cases where electronic completion is not possible, the form can be printed and completed manually. Print a clear copy of the form using a high-quality printer. Ensure the ink is dark and legible. Complete all sections using a pen with dark ink. Carefully fill in all the requested information, ensuring the accuracy of all data.

Sign the form in the designated area with your original signature. A witness signature may be required, depending on the specific policy. If a witness signature is required, obtain the signature of a person who is not a party to the agreement.

Submission Methods

Various methods are available for submitting the completed form. The chosen method should align with the instructions provided by the insurance company. The submission method may depend on the type of insurance and the specific policy.

- Online Portal: The most common and often easiest method is to submit the completed form through the online portal. Follow the submission instructions carefully. Ensure the portal accepts the file type (e.g., PDF, DOC). Verify the submission is successful by checking for confirmation messages.

- Fax: Fax submission is another option. Ensure the form is scanned as a high-quality document. Use the provided fax number and adhere to the fax submission guidelines.

- Mail: Mail submission is a more traditional method. Ensure the form is enclosed in a sealed envelope. Include any necessary supporting documents and address the envelope to the correct address provided by the insurance company. Keep a copy of the submitted form and all supporting documents for your records.

Retaining a Copy of the Form

It is essential to retain a copy of the completed form for your personal records. This copy serves as proof of submission and allows you to track the progress of your insurance application. The copy can be used as evidence of your agreement with the insurance company. Storing the form in a secure location will protect it from damage or loss.

Maintain copies of all related documents for future reference.

Form Variations and Comparisons

Different types of “agreement to provide insurance form” PDFs cater to various needs and situations. Understanding the key differences in format and content allows users to select the most appropriate form for their specific circumstances. This section analyzes common variations, highlighting their distinctive features and use cases.

Different Form Types

Different forms may exist based on the type of insurance being provided, the nature of the agreement, or the parties involved. These variations affect the scope of coverage and responsibilities Artikeld in the agreement. Recognizing these differences is crucial for ensuring a legally sound and comprehensive agreement.

| Form Type | Key Differences | Use Cases |

|---|---|---|

| Individual Health Insurance Agreement | Focuses on individual coverage, typically outlining premiums, benefits, and exclusions specific to the insured person. May include provisions for dependents. | Covers individual health insurance policies, ensuring a clear understanding of the agreement between the insurer and the insured. |

| Group Health Insurance Agreement | Addresses group coverage, outlining the terms for the entire group, including eligibility criteria, premium contributions, and benefits available to each member. | Suitable for employer-sponsored group health insurance plans, encompassing multiple individuals under a single agreement. |

| Commercial Property Insurance Agreement | Details the coverage for commercial properties, including specific perils, limits, and exclusions. May include clauses for liability and business interruption. | Used for insuring commercial buildings, inventory, or other business assets. |

| Auto Insurance Agreement | Artikels coverage for vehicles, including liability, collision, and comprehensive coverage. Specific details regarding the insured vehicle(s) are included. | Essential for insuring vehicles, ensuring a clear understanding of coverage, limitations, and responsibilities of both the insurer and the insured. |

| Life Insurance Agreement | Defines the terms of life insurance policies, specifying coverage amounts, payment schedules, and beneficiary designations. | Used for providing financial protection to beneficiaries in case of the insured’s death. |

Comparison of Content and Format

The format and content of insurance agreements vary depending on the specific type of insurance. For instance, an individual health insurance agreement may include details about pre-existing conditions, while a commercial property insurance agreement might specify the location and type of property.

Use Cases for Each Form Type

Each form type serves a particular purpose. Individual health insurance agreements protect individual health, while group health insurance agreements cover multiple individuals under a shared plan. Commercial property insurance safeguards commercial assets, and auto insurance protects vehicles. Life insurance policies provide financial security to beneficiaries. The choice of form directly impacts the coverage and protection offered.

Filling out that agreement to provide insurance form PDF can be a drag, but hey, at least Yellow Springs, Ohio, has some seriously tasty eats! Check out the local food scene in Yellow Springs, Ohio, for some seriously delicious options. food in yellow springs ohio You’ll need that insurance, though, so don’t forget to finish that form.

It’s essential to have everything in order, right?

Data Security and Privacy

Protecting the sensitive information provided on this insurance agreement form is paramount. Maintaining the confidentiality and integrity of personal data is crucial for building trust and complying with relevant regulations. This section details the measures implemented to safeguard the information collected.Data security and privacy are essential aspects of any form requiring personal information. This form prioritizes the security and privacy of the data provided by the applicant.

The security measures described below ensure the confidentiality and integrity of the information collected.

Importance of Data Security and Privacy

Data security and privacy are critical for maintaining trust and complying with legal obligations. Protecting sensitive information, such as personal details and financial data, is vital for preventing misuse, unauthorized access, and potential breaches. Failure to safeguard data can result in financial losses, reputational damage, and legal repercussions.

Protecting Sensitive Information

To safeguard the sensitive information collected on the form, robust security protocols are in place. These include encryption technologies, access controls, and regular security audits. Data is stored on secure servers with limited access, ensuring only authorized personnel can access it. Strong passwords and multi-factor authentication are required for all user accounts.

Confidentiality Measures

Confidentiality of the information is ensured through a combination of technical and administrative controls. Data encryption safeguards information during transmission and storage. Access controls limit access to sensitive data to only authorized personnel. Regular security assessments and audits help identify and mitigate potential vulnerabilities.

Security Breach Procedures

A detailed incident response plan is in place to handle security breaches. This plan Artikels the steps to be taken in case of a data breach, including notification of affected individuals, reporting to regulatory bodies, and implementing corrective actions. Prompt and appropriate responses are crucial in minimizing the impact of a breach. For example, if a security breach is suspected, the affected parties must be notified promptly, the source of the breach must be investigated, and preventive measures must be implemented to prevent future breaches.

Adherence to Data Privacy Regulations

Adherence to data privacy regulations, such as GDPR (General Data Protection Regulation), is a top priority. The form and associated processes comply with applicable data protection laws. Compliance ensures that the processing of personal data is lawful, fair, and transparent. Regular reviews and updates of policies and procedures maintain compliance with evolving regulations. For example, the company complies with GDPR’s principles of lawfulness, fairness, and transparency in the collection, use, and disclosure of personal data.

Troubleshooting and Common Issues: Agreement To Provide Insurance Form Pdf

This section addresses potential problems encountered during the insurance form completion process. Understanding these issues and their solutions will streamline the process and minimize errors. Efficient troubleshooting ensures accurate data entry and a smooth application submission.Form completion can be challenging due to various factors. Poorly understood terminology, conflicting information, or technical difficulties can lead to errors. This section provides solutions for common problems, and a method for requesting assistance.

Potential Problems During Form Completion

Form completion errors often stem from unclear instructions, ambiguous terminology, or difficulties with the online form interface. Misunderstandings regarding specific fields or required information can lead to incomplete or inaccurate entries. Inaccurate data entry or selection of incorrect options can significantly affect the form’s validity. Technical issues like slow internet connections or software glitches can also hinder the process.

Solutions for Common Issues

A clear understanding of the form’s instructions and fields is crucial. Reviewing the form’s instructions carefully before starting is essential. Double-checking the entered information, especially critical data, is a preventative measure. For ambiguous terms, consult the glossary or seek clarification. If technical issues arise, try troubleshooting by restarting the browser, checking internet connectivity, or using a different device.

The use of a reliable internet connection and compatible software ensures a smooth form completion process.

Filling out the agreement to provide insurance form PDF is crucial for smooth procedures. If you’re heading to the blood bank cleveland memphis tn, blood bank cleveland memphis tn , having this form ready will speed up the process, ensuring a quick and efficient donation. Make sure you’ve got all the necessary info handy for the agreement to provide insurance form PDF, though.

Troubleshooting Guide

The following table provides a guide for common form completion issues and their solutions.

| Problem | Solution |

|---|---|

| Unclear instructions | Thoroughly review the form instructions and seek clarification from support if needed. Use the provided glossary to understand specific terms. |

| Ambiguous terminology | Consult the glossary or contact support for clarification on any ambiguous terms or field definitions. |

| Conflicting information | Carefully review all provided information and identify any discrepancies. If inconsistencies remain, contact support for assistance. |

| Incorrect data entry | Double-check all entered data for accuracy. Pay close attention to dates, numbers, and specific requirements for each field. |

| Technical issues (slow internet) | Try troubleshooting the internet connection. If the problem persists, try completing the form on a different device or during a different time period. |

| Software glitches | Clear your browser’s cache and cookies. Restart your browser or device. If the issue persists, contact support for assistance. |

Requesting Clarification or Assistance

If you encounter difficulties completing the form, a dedicated support channel is available. This channel provides a method to obtain clarification or assistance with specific issues. The contact information is provided in the form footer or the form’s introduction. Providing specific details about the problem, such as the form section causing difficulty, will help the support team efficiently address your concern.

This structured approach to seeking assistance ensures a prompt and effective resolution.

Illustrative Examples

This section provides practical examples to illustrate the proper completion and potential issues with the insurance agreement form. Understanding these examples will help ensure accurate and complete form submissions.These examples demonstrate various scenarios, including a correctly completed form, an incomplete form, a sample form structure, and a hypothetical dispute scenario. This aids in comprehension and application of the form’s use.

Completed Form Sample

This example showcases a correctly completed form. Data is entered accurately and completely within the designated fields. Note the clear formatting and consistent use of the required information.

| Field Label | Data Entry |

|---|---|

| Applicant Name | Jane Doe |

| Policy Type | Homeowners |

| Policy Term (Years) | 5 |

| Premium Amount | $1,200 |

| Date of Birth | 1985-03-15 |

| Address | 123 Main Street, Anytown, CA 91234 |

Incomplete Form Sample

This example highlights a form with missing or improperly filled data fields. This illustrates the importance of completing all necessary sections accurately. Incomplete or inaccurate information can lead to form rejection or issues with processing the insurance agreement.

| Field Label | Data Entry |

|---|---|

| Applicant Name | Jane Doe |

| Policy Type | |

| Policy Term (Years) | 5 |

| Premium Amount | $1,200 |

| Date of Birth | 1985-03-15 |

| Address | 123 Main Street, Anytown, CA 91234 |

Note the blank Policy Type field. This demonstrates a critical omission that could lead to processing problems.

Form Structure Example

This example visually displays the structure of the form, outlining the fields and their corresponding labels. Proper formatting and clear labeling are essential for accurate data entry and processing.

| Field Label | Data Type | Description |

|---|---|---|

| Applicant Name | Text | Full name of the applicant |

| Policy Type | Dropdown | Type of insurance policy (e.g., Homeowners, Auto) |

| Policy Term (Years) | Number | Duration of the insurance policy in years |

| Premium Amount | Currency | Total premium amount |

| Date of Birth | Date | Applicant’s date of birth |

| Address | Text | Complete address of the applicant |

Hypothetical Dispute Scenario

A hypothetical dispute over an insurance agreement highlights the form’s role in resolving disagreements. The completed form serves as crucial evidence in cases of disputes. In the event of a claim or dispute, the form’s accuracy and completeness are critical for determining the terms of the agreement and resolving the matter.

A homeowner, Sarah Jones, filed a claim for damages to her home. The insurance company, after reviewing the insurance agreement form, determined that the policy did not cover the damages because the policy excluded damage from flood events. The form, which detailed the policy’s exclusions, proved pivotal in the dispute’s resolution.

Closure

In conclusion, the agreement to provide insurance form PDF is a critical document that demands meticulous attention to detail. This guide offers a comprehensive overview of its components, legal considerations, and practical application. By understanding the intricacies of the form, individuals can navigate the insurance process confidently and avoid potential pitfalls. Adherence to the Artikeld procedures ensures compliance and protects the rights of all parties involved.

FAQs

What are the common clauses found in insurance agreements?

Common clauses include those pertaining to coverage limits, exclusions, and the responsibilities of both the insured and the insurer. Specific clauses may vary based on the type of insurance.

What are the potential consequences of incomplete or inaccurate information on the form?

Inaccurate or incomplete information can lead to denial of claims, invalidating the agreement, or triggering legal issues. It is crucial to provide accurate and complete data.

How can I ensure the form complies with relevant regulations?

Consult with legal professionals or relevant regulatory bodies to ensure compliance with specific state or federal regulations related to insurance agreements.

What are the different methods for submitting the form?

Methods can include online portals, fax, mail, or in-person submission, depending on the insurer’s procedures. The agreement should specify the preferred submission method.