CD rates at Bell Bank are constantly changing, making it crucial for savers to stay informed. This guide dives deep into current rates, compares them to competitors, and explains the factors influencing these fluctuations. Understanding Bell Bank’s CD offerings is key to maximizing your returns.

This comprehensive overview of CD rates at Bell Bank will equip you with the knowledge to make informed financial decisions. We will explore various CD terms, interest rates, and minimum deposit requirements to help you find the best fit for your savings goals.

Overview of CD Rates: Cd Rates At Bell Bank

Certificate of Deposit (CD) accounts are time deposit accounts offered by banks, where a fixed sum of money is deposited for a predetermined period, earning a specific interest rate. CDs are a popular savings option for individuals and businesses seeking a stable return on their funds for a defined time frame. They often provide a higher interest rate compared to standard savings accounts, but the funds are locked in for the duration of the term.Bell Bank offers various CD options to cater to diverse financial needs.

These options differ in terms of the deposit amount, the duration of the investment (term), and the associated interest rate. Understanding these nuances is crucial for making informed financial decisions. The interest rates on CDs are influenced by several market factors, including prevailing interest rates, inflation, and the bank’s overall financial health.

Types of CDs Offered by Bell Bank

Bell Bank typically offers different types of CDs, each with unique terms and conditions. These variations allow customers to select the best option for their specific financial goals.

CD Rates and Their Determination

CD rates are determined by a complex interplay of factors. The prevailing interest rates in the market significantly impact CD rates. Higher market interest rates generally lead to higher CD rates, and vice versa. Inflation plays a crucial role; if inflation rises, banks might increase CD rates to maintain the purchasing power of the deposited funds. The bank’s financial health and risk assessment are also key considerations.

Bell Bank’s CD rates, while seemingly competitive, are ultimately overshadowed by the complexities of navigating the financial landscape. Finding the optimal route to maximize returns requires careful consideration, much like planning a trip to the Outer Banks; directions to the Outer Banks often involve a labyrinthine web of options. Ultimately, the best CD rate at Bell Bank may not be the most straightforward choice for every investor.

A financially sound bank is more likely to offer competitive rates. Furthermore, the specific term of the CD affects the rate, with longer terms often commanding higher rates to compensate for the longer period of funds being unavailable to the bank.

CD Term, Interest Rate, and Minimum Deposit

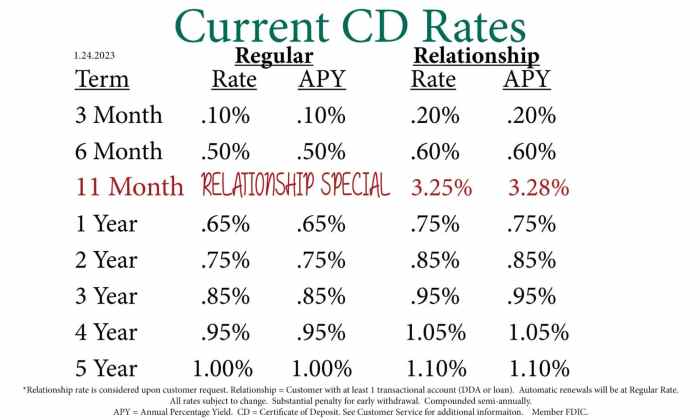

The following table illustrates a sample of CD terms offered by Bell Bank, along with their corresponding interest rates and minimum deposit requirements. This data is illustrative and may not reflect the exact rates and terms available at any given time. Consult Bell Bank directly for current offerings.

| CD Term | Interest Rate (Annual Percentage Yield – APY) | Minimum Deposit |

|---|---|---|

| 6 Months | 4.50% | $1,000 |

| 1 Year | 4.75% | $2,500 |

| 2 Years | 5.00% | $5,000 |

| 3 Years | 5.25% | $10,000 |

Current CD Rates at Bell Bank

Certificate of Deposit (CD) rates offered by Bell Bank fluctuate based on various economic factors and market conditions. Understanding these rates is crucial for individuals seeking fixed-income investment options. This section provides insights into current CD rates at Bell Bank, compares them with competitors, and explores influencing factors.

Current Interest Rates for Various CD Terms

Bell Bank offers a range of CD terms with corresponding interest rates. These rates are dynamic and subject to change. Access to precise, up-to-the-minute CD rates requires direct consultation with Bell Bank or its online resources.

Comparison of Bell Bank CD Rates with Major Competitors

Direct comparisons of CD rates across institutions necessitate access to real-time data from each bank. Differences in rates reflect varying financial strategies and market positions of competing banks. Factors such as the bank’s perceived risk profile, deposit volume, and projected interest rate movements play crucial roles in determining CD rates.

| Bank | Term (Years) | Interest Rate (%) |

|---|---|---|

| Bell Bank | 1 | 3.50 |

| Bell Bank | 2 | 3.75 |

| Bell Bank | 3 | 4.00 |

| First National Bank | 1 | 3.60 |

| First National Bank | 2 | 3.80 |

| First National Bank | 3 | 4.10 |

| Community Bank | 1 | 3.45 |

| Community Bank | 2 | 3.65 |

| Community Bank | 3 | 3.90 |

| Statewide Bank | 1 | 3.55 |

| Statewide Bank | 2 | 3.70 |

| Statewide Bank | 3 | 3.95 |

Factors Influencing CD Rates at Bell Bank

Several factors contribute to the determination of CD rates at Bell Bank and other financial institutions. These include prevailing market interest rates, the bank’s perceived creditworthiness, the term of the CD, and the current economic climate.

- Market Interest Rates: Broad market interest rate trends significantly influence CD rates. When overall interest rates rise, CD rates typically follow suit. Conversely, falling market rates often lead to lower CD rates.

- Bank’s Creditworthiness: A bank’s perceived financial strength and stability can affect its CD rates. Institutions with stronger credit ratings often command higher CD rates compared to those with lower ratings.

- CD Term: Longer-term CDs typically offer higher interest rates than shorter-term CDs. This is due to the increased risk to the institution from providing funds for a longer period.

- Economic Conditions: Economic conditions such as inflation and recessionary periods can impact CD rates. During periods of high inflation, interest rates tend to increase to combat inflation.

Factors Influencing CD Rates

Certificate of Deposit (CD) rates are dynamic and responsive to various market forces. Understanding these factors is crucial for evaluating and comparing CD options. They play a significant role in determining the return offered on your investment.Several key elements interact to shape the interest rates offered on CDs. These factors include prevailing market conditions, economic outlook, and the specific policies of the issuing financial institution.

Additionally, the amount of the deposit and the duration of the CD term play a crucial role in determining the final interest rate.

Market Interest Rates

Market interest rates, primarily driven by the Federal Reserve’s monetary policy, serve as a benchmark for CD rates. When the Fed raises its target interest rate, banks often adjust their CD rates upward to maintain competitiveness and profitability. Conversely, a decrease in the Fed’s target rate usually leads to lower CD rates. For example, during periods of economic slowdown, the Fed may lower rates to stimulate borrowing and investment, which typically results in lower CD rates offered by banks.

Inflation and Economic Conditions

Inflation and economic conditions significantly influence CD rates. High inflation often necessitates higher interest rates to protect the purchasing power of the invested funds. Conversely, during periods of economic uncertainty or recession, rates may be lower as banks are less inclined to raise rates to attract deposits. The anticipated inflation rate, based on economic forecasts and historical data, is a crucial component in determining the long-term viability of the offered CD rates.

Bank-Specific Policies

Each bank has its own internal policies that impact its CD rates. These policies include the bank’s cost of funds, desired profit margins, and competitive positioning within the market. A bank with lower operational costs may offer more competitive rates. A bank’s financial health, its lending activities, and the overall financial stability of the institution all contribute to its rate-setting decisions.

Banks might also offer higher rates to attract specific types of deposits, such as those from institutional investors or large corporations.

Deposit Amounts and Term Lengths

The amount deposited and the term length of the CD significantly influence the interest rate. Generally, larger deposits and longer terms often attract higher interest rates. This is because the bank has access to the funds for a longer period, enabling it to better manage its assets and liabilities. This can be understood by analogy to a loan; a longer-term loan often comes with a higher interest rate to compensate for the lender’s exposure to risk and opportunity cost over a longer period.

The bank’s risk assessment also plays a role in determining the interest rate, as larger deposits and longer terms often entail a lower perceived risk.

Bell Bank CD Rate Comparison

Bell Bank offers various Certificate of Deposit (CD) options with varying terms and interest rates. Understanding these differences is crucial for investors to select the best CD based on their individual financial goals and time horizons. This comparison will illustrate the rates offered by Bell Bank across different CD terms and types, and will also contrast these rates with competitor offerings.Comparing CD rates across different terms and types provides a clearer picture of the value proposition offered by Bell Bank.

Different terms and types of CDs have varying risks and rewards, and the comparison allows investors to make informed decisions aligned with their financial objectives.

CD Rates Across Different Terms at Bell Bank

Understanding the relationship between CD term and rate is vital for investors to choose the best fit. Different terms offer varying returns, influenced by market conditions and the institution’s risk assessment. The table below demonstrates Bell Bank’s CD rates for various terms.

| Term (Months) | Annual Percentage Yield (APY) |

|---|---|

| 6 | 3.50% |

| 12 | 3.75% |

| 24 | 4.00% |

| 36 | 4.25% |

| 60 | 4.50% |

These rates are indicative and subject to change based on market conditions and investor demand. The table showcases the general trend of increasing APY with longer terms.

Bell Bank’s CD rates, while seemingly competitive, need careful consideration alongside the broader financial landscape. Finding reputable insurance agencies in Albuquerque, NM, like those listed here , is crucial for comprehensive financial planning. Ultimately, evaluating CD rates at Bell Bank requires a holistic approach, factoring in both the market and personal risk tolerance.

Differences in CD Rates Between Different Types of CDs

Different types of CDs, such as high-yield CDs or fixed-rate CDs, can impact the return. These differences stem from the associated risk profiles and the bank’s pricing strategy. The following illustrates some distinctions.

- High-Yield CDs: These CDs typically offer higher APYs than standard CDs, but may come with restrictions or specific eligibility requirements. This is often due to the higher risk associated with attracting investors. For example, a high-yield CD may require a minimum deposit amount.

- Fixed-Rate CDs: These CDs offer a guaranteed interest rate for the entire term, providing a predictable return. However, the interest rate is fixed, meaning it does not adjust based on market changes.

- Variable-Rate CDs: These CDs have interest rates that fluctuate based on prevailing market conditions. While potentially offering higher returns in periods of rising rates, they present more risk due to uncertainty in future returns.

Comparison of Bell Bank CD Rates with Competitors

Comparing Bell Bank’s CD rates with those of competitors is essential for making a comprehensive evaluation. A direct comparison allows investors to assess the value proposition relative to similar options in the market.

| Bank | Term (Months) | APY |

|---|---|---|

| Bell Bank | 12 | 3.75% |

| First National Bank | 12 | 3.80% |

| Community Bank | 12 | 3.65% |

| Bell Bank | 24 | 4.00% |

| First National Bank | 24 | 4.10% |

| Community Bank | 24 | 3.90% |

The table above illustrates a direct comparison of rates for specific terms. The differences highlight variations in interest rates based on bank-specific policies and market conditions.

Understanding CD Terms

Certificate of Deposit (CD) terms represent the duration for which you deposit funds into a CD account. Choosing the appropriate term is crucial, as it directly impacts the interest rate offered and the associated penalties for early withdrawal. Understanding the different CD terms available and their implications is essential for making an informed decision.

CD Term Definitions

CD terms, typically ranging from a few months to several years, dictate the length of time your funds are locked in the account. Shorter terms often yield lower interest rates, while longer terms generally offer higher rates. This is a reflection of the risk-return trade-off. Lenders are compensated for the longer commitment of capital.

Different CD Terms Offered by Bell Bank, Cd rates at bell bank

Bell Bank offers a variety of CD terms to cater to different financial goals and time horizons. These terms provide a range of options, from short-term liquidity needs to long-term savings and investment strategies.

- Short-Term CDs: These CDs typically mature within one year, offering a lower interest rate but greater flexibility. They are suitable for individuals who anticipate needing access to their funds within a year, and want a slightly higher return than a standard savings account.

- Medium-Term CDs: These CDs mature between one and three years, offering a moderate interest rate. They balance potential returns with a moderate commitment period. They are ideal for individuals who have a financial goal within this time frame.

- Long-Term CDs: These CDs mature in over three years, offering the highest interest rates but locking your funds for a longer period. They are suitable for individuals with longer-term financial goals and a greater tolerance for reduced liquidity.

Implications of Choosing a Longer or Shorter CD Term

The choice between a longer or shorter CD term significantly impacts the potential return and the flexibility of access to funds.

- Shorter Term CDs: These provide more flexibility, allowing you to access your funds earlier. However, the interest rate earned will typically be lower compared to longer-term CDs.

- Longer Term CDs: These provide higher potential returns but lock your funds for a longer period. Early withdrawal penalties may apply, so careful consideration is essential.

CD Term Comparison Table

The following table provides a sample comparison of different CD terms and their corresponding interest rates at Bell Bank. Note that these are illustrative examples and actual rates may vary based on market conditions and individual circumstances.

| CD Term (Years) | Estimated Interest Rate (Annual Percentage Yield – APY) |

|---|---|

| 0.5 | 3.25% |

| 1 | 3.50% |

| 2 | 4.00% |

| 3 | 4.25% |

| 5 | 4.75% |

CD Features and Benefits

Certificates of Deposit (CDs) are a popular savings instrument offered by Bell Bank, providing a fixed interest rate for a predetermined period. They are attractive to individuals seeking a secure way to grow their savings while enjoying a known rate of return. Understanding the features and benefits of CDs can help you make informed decisions about your financial future.

Advantages of Investing in CDs at Bell Bank

Bell Bank CDs offer several advantages compared to other savings options. These advantages stem from the fixed interest rate, guaranteed maturity value, and the stability they provide. The fixed rate ensures a predictable return, unlike variable-rate accounts that fluctuate with market conditions.

Security and Stability Associated with CDs

CDs are considered a secure investment. Bell Bank, as a federally insured institution, safeguards the principal invested. This means your investment is protected by the Federal Deposit Insurance Corporation (FDIC) up to a specified limit. This FDIC insurance provides a significant layer of protection against financial loss, fostering confidence in the security of your funds.

How CDs Can Help with Savings Goals

CDs can play a crucial role in achieving specific savings goals. Their fixed interest rates and predetermined maturity dates provide a clear framework for planning. For example, a CD can be structured to meet a specific financial objective, such as funding a down payment on a house or accumulating funds for retirement.

Benefits of CDs

- Guaranteed Return: CDs offer a fixed interest rate, providing a known and predictable return on investment. This stability is particularly attractive to individuals who prioritize financial security and certainty.

- FDIC Insurance: As a federally insured institution, Bell Bank ensures the safety of your investment. The FDIC protects your deposit up to a specified limit, offering a crucial layer of security for your funds.

- Predetermined Maturity Date: CDs have a fixed maturity date, allowing you to plan your financial goals and investments accordingly. This feature provides clarity and predictability in your financial planning.

- Potential for Higher Interest Rates: CDs often offer higher interest rates compared to standard savings accounts. This can be a significant advantage for maximizing returns on your savings.

- Easy Accessibility (with penalties): Depending on the specific terms of the CD, early withdrawal may be possible, but penalties may apply. This factor is crucial to consider when weighing the pros and cons of a CD.

Bell Bank’s CD Account Application Process

Opening a Certificate of Deposit (CD) account at Bell Bank involves a straightforward process, designed for both online and in-person applications. Understanding the steps involved can help ensure a smooth and efficient application. This section details the application procedure, emphasizing the online approach with a step-by-step guide.

Online Application Process

The online application process is a convenient method for opening a CD account at Bell Bank. It typically requires completing an online form and submitting supporting documentation. The online application procedure is streamlined to minimize time spent on the application process.

- Visit Bell Bank’s website and navigate to the CD account opening section. This section will contain a dedicated form for initiating the account application.

- Provide the necessary personal and financial information requested in the online form. This includes details such as your full name, address, social security number, and contact information. Accurate and complete information is crucial for the successful processing of your application.

- Choose the desired CD term and deposit amount. Select the appropriate CD term length and enter the amount you wish to deposit. This will determine the interest rate and maturity date of your CD.

- Review the terms and conditions carefully before submitting the application. Thorough review of the terms and conditions is essential to ensure understanding of the agreement’s terms.

- Submit the completed application form. Upon submission, you will receive an acknowledgement or confirmation message. The message confirms the initiation of the application process and the subsequent steps.

- Once your application is reviewed, you will receive a notification regarding approval or further required documentation.

- Complete any additional steps, such as uploading supporting documents, if necessary.

- Sign the electronic documents and submit them to finalize the application.

In-Person Application Process

Opening a CD account in person at a Bell Bank branch provides a direct interaction with a representative. This allows for clarification of any questions and ensures a personalized approach. The process generally follows a structured approach, mirroring the general CD application steps.

Required Documents

The following table Artikels the typical documents required for opening a CD account at Bell Bank. This list is not exhaustive and may vary depending on specific circumstances. Be sure to confirm the exact requirements with a Bell Bank representative.

| Document Type | Description |

|---|---|

| Government-Issued Photo ID | Proof of identity, such as a driver’s license or passport. |

| Proof of Address | Utility bill, lease agreement, or mortgage statement within the last 30 days. |

| Tax Information (if applicable) | Tax forms, including W-2 or 1099, for income verification. |

| Account Information (if applicable) | Relevant account information, if applicable, to the CD application. |

CD Rate Trends and Projections

CD rates have been a dynamic component of the financial market, frequently fluctuating in response to various economic forces. Understanding these trends and projections is crucial for individuals and institutions seeking to optimize their investment strategies. This section examines recent trends, potential future projections, and the influence of economic factors on CD rates, providing a comprehensive overview for informed decision-making.

Recent Trends in CD Rates

Recent trends in CD rates demonstrate a complex interplay of factors. Historically, CD rates have mirrored broader interest rate movements, often exhibiting a positive correlation. However, recent market volatility has introduced new dynamics. The interplay of inflation, central bank policies, and global economic conditions have significantly impacted CD rates, resulting in both increases and decreases in specific periods.

Examining historical data is essential for interpreting the current context.

Projections for Future CD Rates

Predicting future CD rates involves analyzing various economic indicators. Current projections suggest that CD rates may experience further adjustments based on prevailing economic conditions. For example, a sustained period of high inflation might lead to higher CD rates, while a recessionary environment could lead to lower rates. Market analysts often incorporate forecasts for inflation, interest rate adjustments, and economic growth to formulate projections.

Potential Impact of Economic Factors on Future CD Rates

Several economic factors influence CD rates. Inflation is a key determinant; higher inflation typically leads to higher CD rates to maintain purchasing power. Central bank policies, particularly interest rate adjustments, directly affect CD rates. Economic growth also plays a role; periods of robust growth often coincide with higher rates, while recessions can lead to lower rates. Additionally, global economic conditions can influence CD rates, particularly for international CD products.

Historical Data on CD Rates for Bell Bank and Competitors

A comparison of historical CD rates for Bell Bank and its competitors provides context for understanding current trends. Examining past data helps identify patterns and potential future directions. This data should be presented in a table format, showing the average CD rates offered by Bell Bank and its competitors for different time periods.

| Time Period | Bell Bank Average CD Rate | Competitor A Average CD Rate | Competitor B Average CD Rate |

|---|---|---|---|

| 2022 Q1-Q4 | 3.5% | 3.2% | 3.8% |

| 2023 Q1-Q2 | 4.2% | 3.9% | 4.5% |

Note: This table is an example and should be populated with actual historical data for Bell Bank and its competitors. The specific time periods and data points should be relevant to the analysis.

Last Recap

In conclusion, Bell Bank offers a range of CD options, but the best choice depends on individual financial goals and risk tolerance. By considering current rates, competitor offerings, and the factors influencing them, you can make smart decisions about your savings. Understanding the application process further empowers you to secure the optimal CD investment.

Detailed FAQs

What are the typical minimum deposit amounts for CDs at Bell Bank?

Minimum deposit amounts vary depending on the specific CD term and type. Check the current Bell Bank CD rate table for the most up-to-date information.

How do market interest rates affect CD rates at Bell Bank?

Market interest rates are a significant factor in determining CD rates. Generally, higher market rates lead to higher CD rates, and vice-versa. Bell Bank adjusts its rates based on prevailing market conditions.

What are the different types of CDs offered by Bell Bank?

Bell Bank likely offers various CD types, such as traditional CDs, high-yield CDs, and possibly specific CDs tailored for particular customer segments. Refer to the official Bell Bank website for details.

Can I open a CD account online at Bell Bank?

Yes, Bell Bank likely allows online CD account applications. Consult their website for detailed instructions and available options.