Certificate of insurance for bounce house rentals is crucial for ensuring safety and legal compliance. This guide delves into the specifics, covering everything from understanding the scope of coverage to verifying its authenticity. We’ll explore the requirements, document structure, potential risks, and provide a sample certificate for your reference.

Bounce house operators must understand the nuances of insurance to protect themselves and their customers. This comprehensive resource provides a clear overview of the process, ensuring you’re equipped with the knowledge needed for responsible and compliant operations.

Scope of Coverage

The realm of bounce house insurance is a labyrinth of potential perils, demanding meticulous scrutiny. Understanding the intricacies of coverage is paramount for safeguarding your investment and mitigating unforeseen liabilities. This intricate web of protection extends beyond mere financial compensation, encompassing the safety and well-being of those who utilize your inflatable haven.A comprehensive bounce house insurance policy acts as a bulwark against the myriad of risks inherent in this business.

It’s a shield against the tempest of unforeseen circumstances, from equipment malfunctions to catastrophic accidents. This protective measure is not merely a formality but a vital component in ensuring the safety and security of everyone involved.

Typical Insurance Coverage for Bounce Houses

Bounce house insurance typically covers damages to the bounce house itself, including accidental punctures, tears, and structural failures. This protection also encompasses the liability arising from injuries sustained by users of the bounce house. This includes medical expenses and legal fees, should a claim arise. The precise scope of coverage, however, is meticulously Artikeld in the policy’s terms and conditions.

Types of Risks and Liabilities Covered

The policy’s protective embrace extends to a variety of risks. Accidental injuries sustained by patrons are typically covered, including medical expenses and lost wages. Property damage stemming from the bounce house’s operation, such as damage to surrounding surfaces, is also often included. This robust coverage safeguards the user’s well-being and your business’s assets. Liability stemming from negligent supervision is another critical component.

Exclusions from Typical Coverage

Certain situations are categorically excluded from coverage. Intentional acts of vandalism or malicious damage, for instance, would not be covered. Similarly, injuries stemming from pre-existing conditions or intoxicated individuals fall outside the policy’s scope. Understanding these exclusions is critical for responsible risk management. These exclusions are designed to limit liability in specific circumstances that are beyond the control or responsibility of the bounce house owner.

Common Add-on Coverages for Bounce Houses

Various add-on coverages can be incorporated to customize the policy’s protective scope. These may include coverage for extended periods of rental, or coverage for specific locations or events. This personalized protection allows you to tailor your insurance needs to your business’s unique requirements. Consider coverage for damage caused by severe weather events. Coverage for events beyond the typical operational risks can provide peace of mind.

Importance of Understanding Limitations of a Certificate of Insurance

A certificate of insurance, while a crucial document, should not be viewed as an exhaustive analysis of the policy’s nuances. Always consult the full policy document to fully grasp the scope of coverage. This careful examination is critical to identify any potential gaps or limitations that could leave you vulnerable. The certificate only provides a snapshot, and the full policy details contain the critical clauses that define the extent of coverage.

Comparison of Coverage Options for Bounce House Rentals

| Coverage Option | Description | Typical Coverage | Potential Limitations |

|---|---|---|---|

| Basic Liability | Covers basic liability from accidents. | Covers bodily injury and property damage | Limited coverage; excludes pre-existing conditions, intentional acts |

| Enhanced Liability | Provides broader coverage than basic liability. | Covers a wider range of injuries and damages, including more extensive medical costs | May have exclusions for specific situations or events. |

| Comprehensive Coverage | Offers the broadest coverage. | Covers virtually all potential risks, including damage to the bounce house itself. | Can be expensive; exclusions might exist. |

Understanding these different options allows you to choose the most suitable coverage for your business. Careful consideration of each option and its inherent limitations is essential. This comparative analysis helps in making informed decisions about the insurance protection you need.

Insurance Requirements

A fortress of safety, a shield against the unforeseen, insurance for bounce house rentals is paramount. Negligence or accidents can quickly escalate into catastrophic financial liabilities. Thorough understanding of the requirements ensures smooth operations and protects both the operator and the public.A robust insurance policy is not merely a legal necessity; it’s a testament to the operator’s commitment to safety and responsible operation.

The intricate web of legal and regulatory frameworks demands a comprehensive approach to insurance.

Common Requirements for Obtaining a Certificate of Insurance

Obtaining a certificate of insurance for bounce house rentals necessitates adherence to specific standards. These include proof of general liability coverage, specifically tailored to encompass the inherent risks associated with the equipment. Umbrella liability coverage often acts as an additional safeguard, providing substantial protection against catastrophic incidents. Furthermore, it’s crucial to confirm the coverage limits are adequate to meet potential claims.

Legal and Regulatory Aspects of Bounce House Insurance

The legal and regulatory landscape surrounding bounce house use varies by jurisdiction. Local ordinances, building codes, and safety regulations often dictate the minimum coverage requirements. Operators must be acutely aware of these regulations and ensure their insurance policies align with the mandated stipulations. Failure to comply can result in severe penalties, including hefty fines or even the temporary or permanent cessation of operations.

Necessary Information for Obtaining a Certificate of Insurance

The insurance provider will require specific details to assess the risks associated with the bounce house operation. This typically includes the bounce house’s specifications (size, weight, age), location of use (park, event, private property), and details of the operator, including their business name, address, and contact information. Proof of operation licenses and permits may also be necessary, depending on the jurisdiction.

Potential Insurance Providers for Bounce House Operators

Numerous insurance providers specialize in catering to the needs of various industries, including recreational equipment rentals. These companies can provide tailored coverage options. Examples include commercial general liability insurers, specialized recreation and entertainment risk providers, and even some large, well-established companies offering multiple lines of coverage. Operators should explore quotes from several providers to compare coverage and premiums.

Role of Insurance in Liability Protection for Bounce House Events

Insurance acts as a crucial safeguard against potential liability. It provides financial recourse for individuals injured while using the bounce house, shielding the operator from substantial financial burdens. This crucial protection allows operators to operate with confidence, knowing that they are financially prepared for any unforeseen circumstances. Insurance coverage helps mitigate the risk of costly lawsuits and legal battles.

Legal Requirements and Regulations for Bounce Houses

| Jurisdiction | Specific Requirements |

|---|---|

| California | Requires permits for public events, ensuring appropriate safety measures are in place. |

| New York | Stricter guidelines for bounce house operation in densely populated areas, with specific requirements regarding operator certification. |

| Florida | Local ordinances vary significantly; operators must research and comply with the regulations of the specific location. |

Note: This table provides a simplified overview; operators should always consult with local authorities for the most current and accurate legal requirements in their specific jurisdiction.

A certificate of insurance for a bounce house rental is crucial for liability protection, especially when considering potential risks associated with children. This is particularly important when hosting events near homes for sale in McLean County KY, such as those currently available on the market. Ensuring adequate coverage protects both the rental company and homeowners, especially when families gather for activities involving bouncy houses.

Document Structure

A certificate of insurance for a bounce house is a crucial document, a testament to the financial protection a business or individual enjoys. Its meticulous structure ensures transparency and verification, safeguarding both the operator and the public. This document meticulously Artikels the coverage provided, enabling swift identification of critical details.

Ensuring a bounce house event is safe requires a certificate of insurance. This crucial document protects event organizers from potential liabilities. Similarly, a successful tour, like Neil Young’s 2024 tour, relies on meticulous planning and risk mitigation. Neil Young’s 2024 tour review highlighted the meticulous preparation involved, underscoring the importance of comprehensive insurance coverage for all aspects of such events.

Therefore, securing a certificate of insurance for your bounce house rental remains paramount.

Typical Format and Structure

The standard format of a bounce house insurance certificate mirrors a formal legal document. It typically includes a header with the insurer’s logo and contact information. A comprehensive description of the insured entity and the type of coverage are prominently displayed. Critical dates, including policy commencement and expiry, are clearly stated. The document’s validity and accuracy are often confirmed by an authorized signature or a seal.

Understanding this structure empowers individuals to quickly assess the scope and validity of the insurance policy.

Key Elements within a Certificate

The certificate’s content is organized to clearly delineate the essential elements of the insurance policy. These key components provide critical insights into the coverage’s specifics. Essential details include the insured’s name, address, and policy number. The type of coverage (e.g., general liability, property damage) is meticulously Artikeld. Crucially, the policy limits and any exclusions are presented.

The effective and expiration dates of the policy are essential components for assessing its current status. Finally, the certificate usually carries the insurer’s contact information and signature.

Table of Sections and Purpose

| Section | Purpose |

|---|---|

| Insured Information | Identifies the party covered by the insurance policy. |

| Policy Details | Specifies the policy number, effective dates, and expiration dates. |

| Coverage Summary | Provides a concise overview of the types of coverage included, such as general liability, property damage, or medical payments. |

| Policy Limits | Artikels the maximum amount the insurance company will pay for a covered claim. |

| Exclusions | Lists specific situations or events that are not covered by the insurance policy. |

| Insurer Information | Includes the insurer’s name, address, and contact information. |

| Signature and Date | Confirms the validity and authenticity of the certificate. |

Reading and Interpreting Information, Certificate of insurance for bounce house

Carefully examining a certificate of insurance for a bounce house involves understanding the nuances of each section. Start by identifying the insured party and verifying the policy details. Then, focus on the coverage summary to determine if the necessary types of insurance are included. Analyzing policy limits and exclusions is vital for assessing the extent of financial protection.

Finally, verify the insurer’s information and the validity of the certificate through the signature and date.

Comprehensive Policy for a Bounce House Business

A comprehensive policy for a bounce house business usually includes general liability insurance, covering claims for bodily injury or property damage caused by the bounce house. It might also include umbrella liability coverage, providing an additional layer of protection for potentially high-value claims. Commercial property insurance safeguards the bounce house itself, protecting against damage or theft. Business interruption coverage addresses potential financial losses resulting from unexpected closures due to incidents.

Examples of Sections

A sample certificate might list “John Doe Bounce House Rentals” as the insured. The policy details could include a policy number of 1234567890, effective from October 26, 2023, and expiring on October 26, 2024. The coverage summary might highlight general liability with a limit of $1,000,000. An exclusion might mention damage caused by intentional acts.

Verification and Validation

Unraveling the intricate tapestry of bounce house insurance demands a rigorous approach to verification and validation. A mere glance at a certificate is insufficient; a thorough examination is paramount. The safety of participants hinges on the veracity of the insurance coverage, demanding meticulous scrutiny. The stakes are high; a lapse in diligence can have catastrophic consequences.

Authenticating the Certificate

Verifying the authenticity of a certificate of insurance is a critical first step. The document’s integrity is paramount; forgeries and fraudulent claims can jeopardize the safety of all involved. This meticulous process necessitates a deep dive into the certificate’s details. Examine the certificate’s physical characteristics: check for watermarks, embossing, and security features. Ensure the issuer’s name, address, and contact information are clearly visible and accurate.

Cross-reference the issuer’s information with publicly available records. A mismatched or non-existent issuer raises serious concerns.

Validating Insurance Coverage

Validating the insurance coverage for bounce houses is not a cursory task. This process involves scrutinizing the policy’s terms and conditions. Assess the policy’s limits of liability, deductibles, and coverage periods. Verify the insured party’s identity and ensure the bounce house falls under the policy’s scope of coverage. Look for exclusions, such as pre-existing conditions or specific activities, that could invalidate the coverage.

A precise analysis of the policy terms is imperative. In cases of complex policies, consulting with an insurance professional is recommended.

Identifying Red Flags

Red flags in certificate of insurance documents can be subtle but are critical to identify. Examine the certificate for inconsistencies in the insured party’s name, address, or policy details. Missing or vague descriptions of the covered property, or inconsistencies in the policy’s dates, raise suspicion. An absence of contact information or a refusal to provide further details should trigger immediate concern.

Moreover, discrepancies between the certificate and the insured party’s representations can be a significant red flag. Be vigilant and meticulously check all aspects.

Pre-Event Insurance Verification

Verifying insurance coverage prior to event use is non-negotiable. The well-being of participants and the protection of the venue are paramount. The consequences of neglecting this critical step can be severe. An inadequate policy can leave individuals and the venue vulnerable to financial repercussions in case of an incident. This crucial step is essential for ensuring a safe and responsible event.

Verification Checklist

- Verify the certificate’s validity by checking the expiration date and confirming its authenticity.

- Confirm the insured party’s identity and ensure the bounce house is listed as covered property.

- Assess the policy’s limits of liability and deductibles, ensuring they meet the event’s requirements.

- Scrutinize the policy’s exclusions and understand if any activities or conditions might invalidate coverage.

- Cross-reference the policy’s information with publicly available records and ensure compliance with relevant regulations.

Verification Steps and Procedures

| Step | Procedure |

|---|---|

| 1. Document Review | Carefully examine the certificate for any inconsistencies or missing information. |

| 2. Information Validation | Cross-reference the certificate details with publicly available records and the insured party’s representations. |

| 3. Coverage Assessment | Analyze the policy’s coverage scope and ensure it aligns with the event’s needs. |

| 4. Red Flag Identification | Look for inconsistencies, missing information, or vague descriptions that may signal a fraudulent or incomplete policy. |

| 5. Policy Confirmation | If necessary, contact the insurance provider directly to confirm the policy’s validity and coverage details. |

Risk Assessment

The very act of providing bounce house rentals presents a unique set of risks that must be meticulously assessed and mitigated. Neglecting these potential dangers can lead to catastrophic consequences, ranging from minor injuries to serious physical harm. Understanding the inherent vulnerabilities and implementing proactive strategies is paramount to ensuring the safety and well-being of all participants.A comprehensive risk assessment for bounce house operations is not merely a regulatory formality; it’s a critical component of operational safety.

A diligent analysis of potential hazards and liabilities, coupled with a proactive approach to mitigating those risks, can significantly reduce the likelihood of accidents and injuries. By anticipating potential issues and developing appropriate safety protocols, operators can transform a potentially hazardous activity into a safe and enjoyable experience for everyone.

Common Risks Associated with Bounce House Use

Bounce houses, while offering hours of fun, present a variety of inherent risks. These range from falls and collisions to entrapment and equipment malfunction. Improper supervision, inadequate maintenance, and unsuitable environmental conditions can amplify these risks, transforming a seemingly harmless activity into a serious safety concern. A careful analysis of these potential dangers is crucial for effective risk management.

- Falls: Users can experience falls from the bounce house structure, particularly during exuberant activity or on uneven surfaces. This risk is compounded by the inherent height of the bounce house, which can lead to more serious injuries in case of falls.

- Collisions: Multiple users interacting within the confined space of a bounce house can lead to collisions. These collisions can result in bruises, cuts, and other injuries. The potential for such collisions is heightened by inadequate supervision or a lack of clear guidelines for user conduct within the bounce house.

- Entrapment: In certain bounce house designs, users may become entangled in zippers, straps, or other components of the structure. This is a serious risk that demands stringent safety measures to prevent such entrapment incidents.

- Equipment Malfunction: A poorly maintained bounce house structure, or one that is exposed to harsh weather conditions, may experience structural failure. This risk underscores the necessity of regular inspections and maintenance protocols for the bounce house equipment.

- Environmental Hazards: Unfavorable weather conditions, like strong winds or rain, can create unsafe situations. Additionally, sharp objects on the ground beneath the bounce house or near the bounce house area pose a serious risk. Such environmental hazards must be considered when evaluating the safety of bounce house use.

Potential Hazards and Liabilities

The potential hazards and liabilities associated with bounce house use extend beyond the immediate area of the bounce house itself. Operators must consider the broader environment, including the surrounding space and potential interactions with other activities. A failure to consider these aspects can lead to unintended consequences and escalate the risk profile.

- Liability to Users: Bounce house operators are legally responsible for ensuring the safety of users. This includes maintaining the bounce house in good condition, providing adequate supervision, and implementing safety protocols to prevent accidents.

- Liability to Third Parties: Operators may also be held liable for injuries to individuals outside the bounce house area if their negligence creates a hazardous situation. This emphasizes the importance of maintaining the bounce house area in a safe condition and establishing adequate safety measures.

- Property Damage: Improperly anchored bounce houses can cause damage to surrounding property. A risk assessment should include considerations for securing the bounce house appropriately to prevent property damage.

Comparison of Bounce House Designs and Materials

The design and materials of a bounce house significantly impact its safety profile. Different designs and materials may be more or less prone to certain risks. A careful evaluation of these factors is essential for selecting the appropriate bounce house for a given event.

- Inflatable vs. Fabric-based: Inflatable bounce houses, while visually appealing, can be more vulnerable to damage from punctures or leaks. Fabric-based bounce houses may be more durable but might pose different types of hazards. The material used must be considered alongside the design and the potential for injury.

- Size and Shape: Larger bounce houses, or those with complex shapes, might create more opportunities for users to collide or become entangled. Smaller, simpler designs may offer a lower risk profile.

Importance of Risk Assessment for Bounce House Operations

A comprehensive risk assessment is an indispensable tool for managing the inherent risks of bounce house rentals. It’s a proactive measure that can significantly reduce the likelihood of accidents, injuries, and associated liabilities. This assessment should be a dynamic process, adapting to changes in circumstances and conditions.

Steps for Conducting a Risk Assessment for Bounce House Rentals

A thorough risk assessment involves a methodical approach, carefully evaluating all aspects of bounce house use. It should be tailored to the specific environment and activity, considering factors such as age range of users, weather conditions, and supervision levels.

- Identify Potential Hazards: Begin by systematically identifying all potential hazards associated with bounce house use. This should include hazards inherent to the bounce house structure, environmental hazards, and potential user behavior.

- Analyze Potential Impacts: Evaluate the potential severity of each identified hazard. Consider the likelihood of each hazard occurring and the potential impact of an accident.

- Develop Mitigation Strategies: Create a plan to mitigate identified hazards. This includes establishing clear safety protocols, implementing preventive measures, and ensuring adequate supervision.

- Document and Review: Thoroughly document the risk assessment process, including identified hazards, potential impacts, and mitigation strategies. Regularly review and update the assessment as necessary.

Risk Factors and Mitigation Strategies

A well-structured table can illustrate the correlation between risk factors and corresponding mitigation strategies.

| Risk Factor | Mitigation Strategy |

|---|---|

| Falls | Ensure proper supervision, clear ground conditions, and age-appropriate user limits. |

| Collisions | Establish clear user guidelines, limit the number of users, and enforce safe playing practices. |

| Entrapment | Regular inspections of the bounce house structure, and immediately address any potential issues. |

| Equipment Malfunction | Conduct regular maintenance checks, use high-quality materials, and have contingency plans in case of malfunctions. |

| Environmental Hazards | Monitor weather conditions, adjust operating hours as needed, and provide suitable ground cover. |

Sample Certificate

The very essence of a bounce house rental business hinges upon meticulous insurance documentation. A robust certificate of insurance, meticulously crafted and undeniably clear, acts as a bulwark against unforeseen calamities, safeguarding both the renter and the business owner from potential financial ruin. It’s a proclamation of financial responsibility, a testament to preparedness.

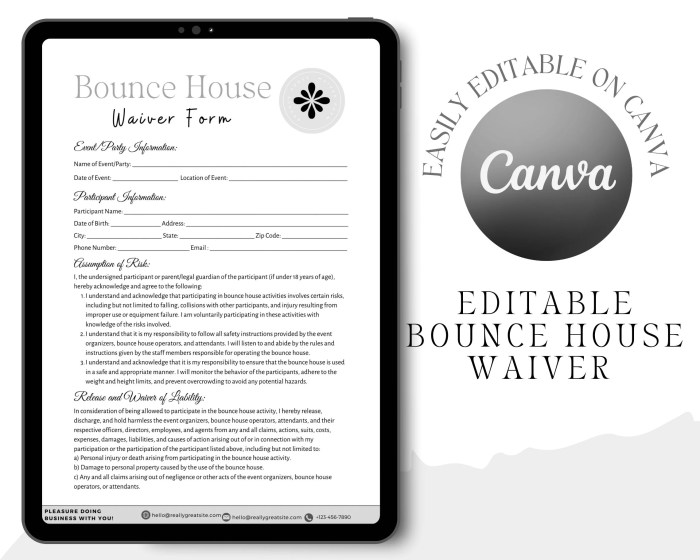

Certificate Structure and Content

A meticulously crafted certificate of insurance, for a bounce house rental business, meticulously details the scope of coverage, the insured entity, and the specific perils the policy addresses. This vital document acts as a tangible demonstration of financial responsibility and preparedness for potential incidents. The structure and content must be precise, unambiguously defining the insurance policy’s terms.

Sample Certificate for a Standard Bounce House

This certificate exemplifies the structure and content for a standard bounce house rental business. The certificate clearly identifies the insured entity, policy limits, and the types of risks covered. It’s a blueprint for clear communication, ensuring that both parties understand the protective umbrella afforded by the insurance policy.

| Detail | Description |

|---|---|

| Insured Entity | “Bounce House Adventures LLC” |

| Policy Number | 2023-12345 |

| Insurance Company | “Reliable Risk Management Inc.” |

| Policy Effective Date | October 26, 2023 |

| Policy Expiration Date | October 26, 2024 |

| General Liability Coverage | $1,000,000 per occurrence |

| Products/Completed Operations Coverage | Included in General Liability |

| Additional Insured | Rental Clients (as per specific agreement) |

| Coverage Territory | Entire United States |

| Type of Bounce House | Standard, 10×10 inflatable bounce house |

| Description of Perils Covered | Bodily injury, property damage, advertising injury. |

Importance of Accuracy

The certificate’s accuracy is paramount. A single discrepancy can unravel the entire protective framework. The certificate must precisely reflect the coverage, limits, and insured parties. Inaccurate information jeopardizes the financial security of all parties involved. An inaccurate certificate of insurance can expose the business and its clients to considerable financial peril.

This demands meticulous review and verification to ensure the certificate accurately reflects the insurance policy’s scope.

Elements of a Valid Certificate

A valid certificate of insurance comprises several crucial elements, each playing a pivotal role in ensuring financial security and protection. These elements, combined, form a comprehensive insurance declaration.

- Insured Entity Information: The certificate explicitly identifies the business entity, providing clear identification.

- Policy Details: The certificate contains the policy number, the insurance company, effective and expiration dates, crucial for policy validity.

- Coverage Limits: This clearly Artikels the maximum amount the insurer will pay for claims.

- Coverage Types: The certificate defines the types of coverage, such as general liability, products/completed operations, and any additional coverages.

- Additional Insured Parties: The certificate clearly identifies additional parties insured under the policy, a critical component for protection.

- Territory of Coverage: This indicates the geographical area where the policy applies.

- Type of Bounce House: For a bounce house rental business, the certificate specifically details the type of bounce house covered.

Last Point

In conclusion, securing the right certificate of insurance for your bounce house business is paramount. Understanding the coverage, requirements, and verification process is key to mitigating risks and ensuring smooth operations. By following the guidelines presented here, you can confidently manage your bounce house rentals while maintaining compliance with legal and safety standards. A thorough risk assessment and proper verification procedures will further protect you and your customers.

Essential FAQs: Certificate Of Insurance For Bounce House

What are common exclusions in bounce house insurance policies?

Exclusions often include damage caused by vandalism, acts of terrorism, or intentional misuse. Always review the specific policy for detailed exclusions.

How can I find potential insurance providers for bounce house rentals?

Online insurance marketplaces, brokers specializing in recreational equipment, and directly contacting insurance companies are viable options. Research and compare policies to find the best fit for your needs.

What are the typical steps to verify a bounce house insurance certificate?

Verify the insurer’s legitimacy, check the policy’s validity period, confirm the insured’s details, and cross-reference the information with the certificate issuer’s records.

What is the importance of risk assessment in bounce house operations?

Risk assessment helps identify potential hazards, such as uneven surfaces, inadequate supervision, or equipment malfunctions. This allows for proactive measures to prevent accidents and ensure safety.