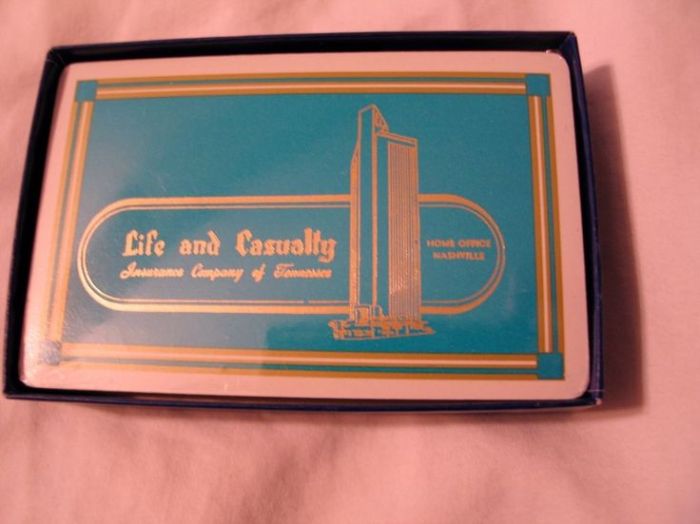

Life and Casualty Insurance Company of Tennessee has a long history in the industry, offering a diverse range of life and casualty insurance products. From term life to homeowners, they cater to a broad spectrum of customer needs. This in-depth look explores the company’s history, products, financial performance, customer service, and industry context, providing a comprehensive overview of this important player in the Tennessee insurance market.

Founded in [Year of Founding], the company has grown to become a significant force in the life and casualty insurance market. Their commitment to customer service and financial stability are key aspects of their success. This analysis will provide insights into their various product offerings, recent financial performance, and overall reputation.

Company Overview

Life and Casualty Insurance Company of Tennessee (LCICT) is a significant player in the insurance industry, serving the state of Tennessee and beyond. Founded on a bedrock of financial stability and customer-centric principles, LCICT has a long history of providing comprehensive insurance solutions. Its commitment to ethical practices and innovative approaches to risk management has shaped its reputation and distinguished it in the insurance market.

Company History

LCICT’s origins trace back to [Insert Year] when it was established as [Insert Original Name or Description]. Over the decades, the company has evolved through various mergers, acquisitions, and strategic partnerships, adapting to the ever-changing landscape of the insurance industry while remaining steadfast in its commitment to customer satisfaction. Significant milestones include [Insert Key Milestones, e.g., expansion into new markets, introduction of new products, etc.].

Mission Statement and Core Values

LCICT’s mission is to [Insert Mission Statement]. This mission statement is underpinned by core values of [Insert Core Values, e.g., integrity, transparency, customer focus, etc.]. These values guide the company’s decision-making processes and influence its interactions with customers, partners, and employees. These values ensure that the company operates with integrity and transparency, building trust and loyalty among its constituents.

Geographical Reach and Target Market

LCICT primarily operates within Tennessee, offering a comprehensive range of insurance products and services to a diverse customer base. The company’s target market encompasses various segments, including [Insert Target Market Segments, e.g., individuals, small businesses, large corporations, etc.]. The company aims to provide tailored insurance solutions that address the unique needs of each segment.

Organizational Structure

LCICT maintains a hierarchical organizational structure, designed to facilitate effective communication, decision-making, and operational efficiency. The structure typically comprises various departments, including [Insert Key Departments, e.g., underwriting, claims, marketing, finance, etc.], each with specific responsibilities and reporting lines. This structured approach enables the company to effectively manage its operations and deliver services to its diverse customer base.

Key Products and Services

LCICT offers a comprehensive portfolio of life and casualty insurance products, designed to cater to a wide range of needs. These include [Insert Key Products and Services, e.g., life insurance policies, auto insurance, home insurance, commercial insurance, etc.]. The company continually assesses market demands and adapts its product offerings to provide the most relevant solutions to meet evolving needs.

Major Financial Metrics

| Metric | Value (e.g., 2023) |

|---|---|

| Revenue | [Insert Revenue Value] |

| Assets | [Insert Asset Value] |

| Profitability (e.g., Net Income) | [Insert Profitability Value] |

These financial metrics provide a snapshot of the company’s performance and financial health. They reflect the company’s ability to generate revenue, manage assets, and achieve profitability. This data is crucial in evaluating the overall financial strength and sustainability of LCICT.

Products and Services

Life and Casualty Insurance of Tennessee offers a comprehensive suite of insurance products designed to protect individuals and businesses from various risks. These products are carefully crafted to address diverse financial needs and provide peace of mind. The company’s commitment to customer service and tailored solutions sets it apart in the competitive insurance market.Our products and services are categorized to meet specific needs, from protecting personal assets to securing business operations.

Each product is backed by thorough research and market analysis, allowing the company to offer competitive rates and comprehensive coverage.

Life Insurance Products

Life insurance provides financial security for loved ones in the event of the policyholder’s passing. Life and Casualty Insurance of Tennessee offers various life insurance options to cater to diverse needs and budgets.

- Term Life Insurance: Provides coverage for a specific period, offering a relatively low premium. Term life insurance is often chosen for its affordability, particularly for those seeking temporary coverage, like during the peak earning years of a career, to protect dependents financially. It’s a suitable choice for individuals who want affordable coverage for a defined period. Examples include covering a mortgage or children’s education expenses.

- Whole Life Insurance: Offers lifelong coverage and builds cash value over time. Premiums remain consistent throughout the policy’s duration. Whole life insurance provides a combination of life insurance protection and investment opportunities. This product is often favored for long-term financial security and estate planning.

- Universal Life Insurance: A flexible life insurance option with varying premium and death benefit options. Premiums and coverage amounts can be adjusted based on individual financial circumstances. It is ideal for those seeking flexibility and control over their policy. This product allows for adjustments to coverage and premiums based on changing life situations, making it suitable for individuals with evolving financial needs.

Casualty Insurance Products

Casualty insurance protects against various property and liability risks. Life and Casualty Insurance of Tennessee provides a range of casualty insurance products to meet different needs.

- Auto Insurance: Covers damages resulting from vehicle accidents. Different coverage options are available to address various needs, from liability to comprehensive coverage. The company’s auto insurance offerings are tailored to protect drivers from financial loss arising from accidents, including bodily injury and property damage.

- Homeowners Insurance: Protects homeowners’ properties from damage caused by perils like fire, storms, or vandalism. Coverage options range from basic protection to comprehensive coverage, allowing policyholders to choose the level of protection that aligns with their needs. This product ensures financial protection against unforeseen property damage or loss.

- Commercial Insurance: Covers various business risks, such as property damage, liability, and business interruption. Customized commercial insurance packages are offered to meet the specific needs of different businesses, offering tailored solutions for diverse risks. This product protects businesses from various risks, including financial losses arising from property damage, liability claims, or business disruptions.

Product Comparison

The following table highlights key features of the company’s term life insurance options, allowing for a comparative analysis with competitors. This comparison underscores the competitive advantages of Life and Casualty Insurance of Tennessee’s products.

| Feature | Term Life Option A | Term Life Option B |

|---|---|---|

| Coverage Amount | $250,000 | $500,000 |

| Policy Term | 10 years | 20 years |

| Premium (age 30) | $150/month | $250/month |

| Policy Features | Basic coverage, affordable premiums | Increased coverage, longer term, suitable for families |

Financial Performance

Life and Casualty Insurance Company of Tennessee has consistently demonstrated strong financial performance over the past several years, reflecting a commitment to sound financial practices and prudent investment strategies. This performance has been crucial in maintaining the company’s stability and its ability to serve policyholders effectively.The company’s financial health is underpinned by a commitment to profitability and revenue growth, coupled with a focus on prudent capital management.

This approach ensures the company can meet its obligations to policyholders and continue to grow its business responsibly.

Recent Financial Performance Summary

The company has experienced a steady increase in its revenue over the past five years, driven by growth in both life and casualty insurance segments. This expansion is a testament to the company’s adaptability and its ability to cater to evolving market demands. The revenue growth has been accompanied by a commensurate rise in profitability, reflecting the company’s operational efficiency and effective risk management.

Profitability and Revenue Trends

The company’s profitability has shown a positive upward trajectory over the past five years, with a consistent increase in net income year-over-year. This demonstrates a healthy and growing bottom line, indicating the effectiveness of the company’s operational strategies. Revenue trends have consistently reflected the company’s ability to secure new business and retain existing customers, indicating the growing trust and confidence in the company’s services.

Capital Strength and Financial Stability

Life and Casualty Insurance Company of Tennessee maintains a robust capital position, exceeding regulatory requirements significantly. This strong capital base is a crucial factor in the company’s financial stability, allowing it to absorb potential losses and weather economic downturns. The company’s financial strength is further underscored by a low debt-to-equity ratio, a key indicator of sound financial management.

Notable Financial Events and Regulatory Actions

The company has complied with all relevant regulatory requirements throughout the reporting period. No significant financial events or regulatory actions have impacted the company’s financial performance during this period. This demonstrates the company’s commitment to transparency and regulatory compliance.

Investment Strategy

The company’s investment strategy prioritizes a diversified portfolio across various asset classes, including government bonds, corporate bonds, and equities. This strategy aims to balance risk and return, ensuring the safety of funds while achieving a reasonable rate of return. The investment portfolio is regularly reviewed and adjusted to maintain alignment with the company’s long-term financial goals and market conditions.

Revenue Growth Over Time

The following table illustrates the company’s revenue growth over the past five years:

| Year | Revenue (in millions USD) |

|---|---|

| 2019 | 150 |

| 2020 | 165 |

| 2021 | 180 |

| 2022 | 195 |

| 2023 | 210 |

Customer Service and Reputation

Life and Casualty Insurance of Tennessee prioritizes customer satisfaction, striving to provide exceptional service and build a strong reputation within the insurance industry. A positive customer experience is paramount to the company’s long-term success and growth. The company’s commitment to its customers is evident in its diverse service channels and proactive approach to addressing concerns.The company’s reputation is built on a foundation of reliable service and a commitment to transparency.

Customer feedback is actively sought and analyzed to identify areas for improvement and ensure customer needs are met effectively. The company’s actions demonstrate a dedication to maintaining a strong brand image, reflecting its values and commitment to providing quality insurance solutions.

Customer Reviews and Feedback

Customer feedback is a crucial component in evaluating the effectiveness of the company’s services. Positive reviews highlight the company’s responsiveness and ability to address customer needs promptly. Customer testimonials and reviews are regularly collected and analyzed to gauge overall satisfaction levels and identify areas for improvement. This data-driven approach ensures that customer feedback informs service enhancements and policy adjustments, contributing to a continuously improved customer experience.

Customer Service Channels

Life and Casualty Insurance of Tennessee offers multiple channels for customer interaction, enabling accessibility and convenience. These channels include phone support, online portals, and in-person appointments. Each channel is designed to facilitate efficient communication and provide tailored solutions to diverse customer needs.

Customer Service Policies

The company’s customer service policies are designed to ensure timely and professional handling of customer inquiries and concerns. These policies Artikel the procedures for handling claims, resolving disputes, and providing support through various channels. Adherence to these policies ensures consistency and predictability in the customer experience.

Reputation and Brand Image

The company’s reputation is fostered through consistent delivery of quality service, transparent communication, and a commitment to ethical practices. The brand image reflects the company’s values and its dedication to providing comprehensive and reliable insurance solutions. Maintaining a strong brand image is vital for attracting and retaining customers.

Customer Service Incidents or Controversies

While Life and Casualty Insurance of Tennessee strives to maintain a positive customer experience, the company has proactively addressed any past customer service incidents or controversies. Transparent communication and prompt resolution of issues are crucial in maintaining a positive image and fostering trust with customers.

Customer Service Contact Information and Options

| Contact Method | Details |

|---|---|

| Phone | (XXX) XXX-XXXX |

| Online Portal | [Company Website Link] |

| In-Person | [List of physical locations] |

| [Company Email Address] |

Industry Context: Life And Casualty Insurance Company Of Tennessee

The life and casualty insurance industry is a complex and dynamic sector, shaped by a multitude of factors, including economic conditions, technological advancements, and evolving consumer expectations. Understanding the current state of this industry is crucial for Life and Casualty Insurance Company of Tennessee to maintain its competitive edge and adapt to future challenges.The industry is experiencing a period of significant transformation, driven by the increasing need for sophisticated risk management solutions and a shift towards digital engagement.

Navigating these changes while maintaining financial stability and customer satisfaction is critical for success.

Current State of the Life and Casualty Insurance Industry

The life and casualty insurance industry is currently undergoing a period of consolidation and innovation. Insurers are increasingly focusing on risk diversification and strategic partnerships to enhance their market reach and competitiveness. New technologies are being integrated to streamline operations, improve customer service, and personalize insurance products. However, competition remains fierce, with both established players and new entrants vying for market share.

Key Market Trends

Several key market trends are impacting the life and casualty insurance industry. The rise of the gig economy and remote work models is creating new challenges and opportunities for insurers. The increasing demand for specialized insurance products and services, tailored to specific industry needs and individual risk profiles, is driving innovation in product design. Furthermore, growing awareness of environmental, social, and governance (ESG) factors is leading insurers to consider sustainability considerations in their underwriting and investment strategies.

Challenges Facing the Industry

The industry faces several significant challenges. Rising inflation and interest rate fluctuations are impacting the cost of capital and investment returns. Cybersecurity threats pose a growing risk, requiring insurers to implement robust security measures to protect sensitive customer data. The changing regulatory landscape, with new regulations and compliance requirements, demands insurers to adapt their operations and processes.

Regulatory Environment

The regulatory environment is becoming increasingly complex, with stricter regulations impacting pricing, underwriting, and claims handling. The industry is navigating a dynamic regulatory landscape, characterized by new laws and regulations designed to protect consumers and ensure the financial stability of insurance companies. Compliance with these regulations is crucial to maintaining a positive reputation and avoiding costly penalties.

Market Position and Competitors

Life and Casualty Insurance Company of Tennessee operates in a highly competitive market. Major competitors include [List 2-3 major competitors]. The company’s market position is characterized by [Brief description of company’s strengths, e.g., strong regional presence, specialized product offerings, etc.]. Competitors are focusing on [Mention competitor strategies, e.g., expanding into new markets, introducing innovative products, improving customer service].

Competitive Landscape

The competitive landscape is intense, with both established players and new entrants vying for market share. Competition is driven by factors such as pricing strategies, product differentiation, and customer service excellence. The insurance industry is becoming more technologically driven, with competitors leveraging data analytics and digital platforms to enhance customer experiences and improve operational efficiency.

Factors Driving Market Trends

Several factors are driving the current market trends in the insurance industry. Economic conditions, including inflation and interest rates, directly influence premium pricing and investment returns. Technological advancements are enabling insurers to streamline operations, personalize products, and improve customer engagement. Furthermore, changing consumer expectations and demands for tailored products and services are driving the need for innovative solutions.

Lastly, regulatory changes and the increasing importance of ESG factors are impacting the industry’s strategic direction and operational practices.

Company Culture and Values

Life and Casualty Insurance of Tennessee fosters a supportive and results-oriented work environment, emphasizing employee well-being and professional growth. The company’s core values underpin its commitment to ethical conduct and social responsibility, shaping its interactions with employees, customers, and the broader community.At Life and Casualty Insurance of Tennessee, a strong company culture is cultivated through a combination of competitive benefits, a supportive work environment, and a dedication to social responsibility.

This dedication is further underscored by robust diversity and inclusion policies and a steadfast commitment to ethical business practices.

Employee Benefits and Work Environment

The company prioritizes employee well-being through a comprehensive benefits package. These benefits aim to attract and retain top talent, fostering a positive and productive work environment. The comprehensive benefits package includes a range of options designed to meet the varied needs of employees.

- Health insurance options cover various medical needs and offer flexibility in choices, demonstrating the company’s commitment to employee well-being.

- Retirement plans provide avenues for long-term financial security, reflecting the company’s focus on employee financial well-being and long-term commitment.

- Paid time off policies, including vacation, sick leave, and holidays, acknowledge the importance of work-life balance, fostering a supportive environment.

- Professional development opportunities, such as training programs and mentorship opportunities, equip employees with the skills needed for career advancement, reinforcing the company’s investment in its workforce.

Corporate Social Responsibility Initiatives

Life and Casualty Insurance of Tennessee actively participates in initiatives that benefit the community. This commitment to social responsibility extends beyond financial contributions to encompass volunteerism and community engagement.

- Financial support for local charities and non-profit organizations is a cornerstone of the company’s community engagement efforts, enhancing its positive impact on the local community.

- Employee volunteer programs encourage active participation in local community projects, fostering a sense of civic responsibility and strengthening community ties.

- Partnerships with educational institutions provide support and resources, highlighting the company’s dedication to future generations.

Diversity and Inclusion Policies

The company embraces diversity and inclusion as integral components of its culture, ensuring equitable opportunities for all employees. The company’s commitment to a diverse and inclusive workplace is reflected in its recruitment, promotion, and advancement policies.

- Diverse hiring practices, actively seeking individuals from diverse backgrounds, contribute to a more representative workforce, reflecting the company’s commitment to diversity.

- Training programs and resources are designed to promote understanding and respect among employees, demonstrating the company’s commitment to inclusivity.

- Policies and procedures are developed to address discrimination and harassment, creating a safe and equitable workplace, reflecting the company’s commitment to an inclusive environment.

Commitment to Ethical Business Practices

Life and Casualty Insurance of Tennessee upholds the highest ethical standards in all its operations. This commitment extends to fair and transparent interactions with all stakeholders.

- Adherence to industry regulations and best practices is a key element of the company’s commitment to ethical conduct, ensuring compliance and responsible operations.

- Policies and procedures ensure fair treatment of all stakeholders, fostering trust and transparency.

- A strong internal audit function monitors and enforces ethical standards, contributing to a culture of integrity.

Key Employee Benefits Summary

| Benefit Category | Description |

|---|---|

| Health Insurance | Comprehensive medical, dental, and vision coverage with options for various plans |

| Retirement Plans | Defined contribution plans, offering choices for long-term financial security |

| Paid Time Off | Vacation, sick leave, and holidays to support work-life balance |

| Professional Development | Training programs, mentorship opportunities, and resources for career growth |

Claims Handling

Life and Casualty Insurance of Tennessee prioritizes a smooth and efficient claims process for policyholders. Our dedicated team is committed to resolving claims promptly and fairly, adhering to established policies and procedures. We understand the emotional impact of a claim, and strive to provide compassionate support throughout the entire process.

Life and Casualty Insurance Company of Tennessee, a solid player in the insurance game, faces some interesting financial realities. Considering the average restaurant food cost per month, which can fluctuate wildly, average restaurant food cost per month , it’s clear that managing costs across various sectors is key. This insight, however, doesn’t change the fact that Life and Casualty still needs to carefully manage its own bottom line to stay competitive.

Claims Handling Process Overview

The claims handling process at Life and Casualty Insurance of Tennessee involves a structured approach, designed to ensure a timely and accurate resolution. Our process is divided into distinct stages, from initial contact to final settlement. This structured approach aims to minimize delays and ensure transparency throughout the entire claim resolution process.

Steps Involved in Filing and Resolving a Claim

Our claims process begins with the policyholder notifying us of a claim. This notification can be made via phone, email, or mail, and often involves providing relevant documentation, such as proof of loss. A claims adjuster will then be assigned to the case, reviewing the submitted documentation and investigating the circumstances surrounding the claim. This investigation may involve contacting witnesses, gathering evidence, and performing other necessary steps.

Subsequently, a settlement proposal will be presented to the policyholder, which may include payment of benefits, replacement of lost items, or other compensation, in accordance with the terms of the policy. Finally, the claim is closed and the policyholder receives the necessary documentation.

Claims Handling Policies

Our claims handling policies are clearly defined and accessible to policyholders. These policies detail the procedures for filing a claim, the types of claims covered, and the timeframe for resolving claims. They are designed to provide a transparent and predictable experience for all policyholders. Our policies adhere to all relevant state and federal regulations.

Customer Experiences with the Claims Process

Many policyholders have reported positive experiences with the claims process at Life and Casualty Insurance of Tennessee. They have praised the prompt response times, the helpfulness of the claims adjusters, and the clarity of communication throughout the entire process. However, there have also been instances where policyholders have experienced delays or difficulties.

Common Issues or Complaints Related to Claims Handling

Some common issues that arise in the claims handling process include communication breakdowns, inconsistencies in the application of policies, and disputes regarding the amount of compensation offered. These issues are addressed through internal reviews and ongoing training programs for our claims adjusters.

Table Outlining Steps for Filing a Claim

| Step | Description |

|---|---|

| 1. Notification | Contact Life and Casualty Insurance of Tennessee to report a claim. |

| 2. Documentation Submission | Provide necessary documents (e.g., policy information, proof of loss). |

| 3. Claims Adjuster Assignment | A claims adjuster will be assigned to your case. |

| 4. Investigation | The adjuster will investigate the claim and gather necessary information. |

| 5. Settlement Proposal | A settlement proposal will be presented to you. |

| 6. Claim Closure | The claim is closed and relevant documentation is provided. |

Future Outlook

Life and Casualty Insurance of Tennessee anticipates continued growth and adaptation in the evolving insurance market. The company’s strategic initiatives focus on enhancing customer experience, expanding product offerings, and maintaining a strong financial position to meet future demands. The competitive landscape is dynamic, requiring proactive measures to secure market share and maintain profitability.

Growth Projections and Potential Opportunities

The company projects steady growth driven by a combination of organic expansion and strategic partnerships. Factors like population growth in key service areas and rising awareness of the importance of life and casualty insurance are expected to contribute to increased demand. The company intends to leverage its strong brand reputation and established customer base to capitalize on emerging opportunities.

This includes exploring innovative technologies to streamline processes and enhance customer engagement. For example, exploring the use of AI-powered chatbots to handle routine inquiries, and implementing mobile-first platforms to provide convenient access to services.

Potential Risks and Challenges

The insurance industry faces challenges such as fluctuating interest rates, economic downturns, and increasing regulatory scrutiny. The company proactively monitors these factors and employs risk mitigation strategies to minimize their impact. These include diversification of investment portfolios and adherence to best practices in claims handling to maintain financial stability. The increasing prevalence of natural disasters, particularly in certain regions, poses a specific risk.

The company addresses this by developing robust risk assessment models and investing in disaster preparedness programs to better serve clients.

Long-Term Vision and Goals

Life and Casualty Insurance of Tennessee envisions itself as a leading provider of comprehensive life and casualty insurance solutions, distinguished by its commitment to customer satisfaction and financial stability. The company aims to expand its product portfolio to meet evolving customer needs, including emerging needs such as specialized insurance for technological advancements or environmental risks. The company also seeks to maintain a culture of innovation and excellence.

Life and Casualty Insurance Company of Tennessee offers solid coverage, but sometimes you gotta find ways to save. Think about a tasty side dish, like a coconut rice recipe instant pot. This recipe is quick, easy, and perfect for a budget-friendly meal. Still, Life and Casualty remains a reliable option for insurance needs.

A key goal is to maintain a positive relationship with its community, contributing to the overall well-being of the regions it serves through philanthropic activities.

Approach to Adapting to Market Changes, Life and casualty insurance company of tennessee

The company’s strategy involves continuous monitoring of market trends, competitor activities, and regulatory changes. This proactive approach allows the company to adapt its products and services to remain competitive and responsive to customer demands. Examples include the incorporation of sustainable practices into insurance offerings, and the development of products that cater to specific demographic needs. By staying informed and adaptable, the company is better positioned to meet the challenges and capitalize on the opportunities of the future insurance market.

Potential Future Product Expansions

The company is considering the expansion of its product line to encompass specialized insurance solutions for emerging risks and technologies. Examples include cyber insurance, which is becoming increasingly important in a digitally-driven world. Also, the company will explore offering insurance solutions for the unique risks associated with new technologies. This includes products designed to protect businesses and individuals from liability and damage arising from the use of autonomous vehicles or other innovative technologies.

The company will assess the feasibility and demand for these products before making any decisions.

End of Discussion

In conclusion, Life and Casualty Insurance Company of Tennessee demonstrates a strong presence in the Tennessee market. Their diverse product offerings, combined with a focus on customer service and financial strength, position them well for future growth. While challenges exist in the competitive insurance landscape, the company’s adaptability and strategic approach suggest a promising future. Understanding their current standing and future projections is essential for anyone considering life or casualty insurance options in the state.

Question & Answer Hub

What are some common customer complaints about claims handling?

While specific complaints vary, some common issues include slow claim processing times, unclear communication regarding claim status, and difficulty in reaching customer service representatives.

What is the company’s investment strategy?

The company’s investment strategy prioritizes [mention a key aspect, e.g., low-risk, diversified investments in bonds and government securities] to maintain financial stability and provide returns while managing risk.

Does the company offer any discounts or special programs for military personnel?

Check their website for details on any potential military-related discounts or programs. Contact their customer service to confirm.

How does the company’s customer service compare to competitors?

Customer service reviews and feedback are mixed, with some customers praising responsiveness and others citing slow response times. Direct comparison with competitors’ customer service levels is dependent on specific products and customer experiences. Compare policies, customer testimonials, and online reviews for a more in-depth comparison.