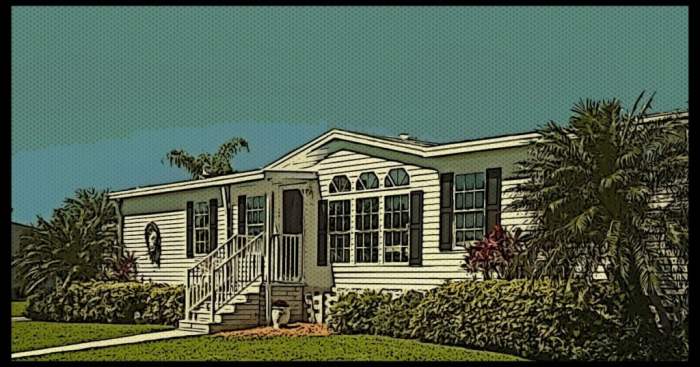

Mobile home rent to own presents a unique path to homeownership, offering a compelling alternative to traditional financing. Imagine the vibrant hues of a meticulously landscaped yard surrounding your new mobile home, the warm glow of sunlight streaming through your windows, and the freedom of building equity step-by-step. This comprehensive guide delves into the intricacies of this increasingly popular option, exploring both the advantages and potential drawbacks.

From navigating the financial landscape to understanding the legal implications and practical considerations, this guide will equip you with the knowledge to confidently explore the world of mobile home rent-to-own. Discover the potential for building a brighter future while avoiding common pitfalls.

Introduction to Mobile Home Rent-to-Own

Unlocking the dream of homeownership just got easier! Mobile home rent-to-own offers a unique path to homeownership, blending the benefits of renting with the eventual possibility of owning your mobile home. It’s a smart financial strategy for those seeking a stable living situation while building equity.Traditional homeownership often requires a substantial down payment and significant upfront costs. Rent-to-own provides a more accessible entry point, allowing individuals to build their financial foundation while enjoying the comforts of home.

This model fosters a smoother transition into homeownership, making it a viable option for many.

Mobile Home Rent-to-Own Concept Overview

The mobile home rent-to-own concept operates on a lease-purchase agreement. This agreement Artikels the terms for renting the mobile home and gradually building equity towards eventual ownership. Crucially, it allows for the development of financial stability and homeownership preparedness.

Key Differences from Traditional Homeownership

Rent-to-own differs significantly from traditional homeownership. Traditional homeownership typically involves a large upfront payment for the property. A rent-to-own model allows for a smaller, more manageable monthly payment, and building equity over time. It’s designed to be a less risky, more accessible route to homeownership.

Types of Mobile Home Rent-to-Own Agreements

Several types of rent-to-own agreements exist, each tailored to specific circumstances. Some agreements may include options for early purchase, or include specific clauses regarding maintenance. Each agreement will vary in terms and conditions.

Common Clauses in Rent-to-Own Agreements

| Clause | Description |

|---|---|

| Payment Terms | This clause details the monthly rent payments, the frequency of payments, and any potential penalties for late payments. Examples include fixed monthly payments, or payments that increase over time as the renter builds equity. |

| Lease Duration | This clause Artikels the length of the lease agreement. This period typically varies depending on the agreement’s specifics, and often aligns with the desired timeframe for the renter to achieve homeownership. Some agreements allow for early termination with penalties. |

| Maintenance Responsibilities | This clause specifies who is responsible for routine maintenance and repairs. Typically, the renter is responsible for routine maintenance, while the seller or owner handles major repairs. Clear definitions are critical to avoid disputes. |

| Purchase Option | This clause details the conditions under which the renter can purchase the mobile home. It often includes a specific price and a process for finalizing the transaction. For instance, some agreements may specify the conditions for an early purchase option. |

| Default and Termination | This clause clarifies the consequences of defaulting on payments or violating other terms of the agreement. It Artikels the steps taken to address missed payments and the process for terminating the lease. |

Advantages of Mobile Home Rent-to-Own

Unlocking homeownership through rent-to-own offers a unique pathway to homeownership, presenting several attractive financial benefits and advantages over traditional financing. This approach often provides a more accessible and flexible entry point to the housing market, particularly for individuals or families seeking to build equity without the hefty upfront costs associated with traditional mortgages.Rent-to-own offers a bridge to homeownership, allowing you to build equity while living in the home, rather than merely paying rent.

This can lead to significant financial advantages compared to traditional financing methods, particularly in fluctuating economic climates or when navigating significant credit challenges.

Financial Benefits of Rent-to-Own

Rent-to-own agreements often feature more flexible payment terms and lower upfront costs compared to traditional mortgage options. This can be especially beneficial for individuals with limited savings or those experiencing financial instability. The initial investment is typically lower, enabling a smoother transition into homeownership. The potential for building equity over time, as payments are made, is a key financial advantage.

Advantages over Traditional Financing

Traditional financing, such as mortgages, often require substantial upfront costs, including closing costs and down payments. Rent-to-own contracts typically have lower initial costs, reducing the financial burden on the buyer. Additionally, rent-to-own programs can provide a more streamlined and flexible process, potentially avoiding the lengthy application and approval processes associated with traditional mortgages. This can be particularly beneficial for those with less-than-perfect credit histories or those seeking a faster path to homeownership.

Tax Implications of Rent-to-Own

The tax implications of rent-to-own arrangements are often similar to traditional rental agreements, with some key differences. Rent payments made during the rent-to-own period are typically deductible as a personal expense. However, the specific tax implications will vary depending on the individual’s circumstances and the terms of the agreement. It is essential to consult with a qualified tax advisor to understand the precise tax implications of your specific rent-to-own agreement.

Mobile home rent-to-own options can be a viable path to homeownership, but understanding the associated costs and terms is crucial. For example, if your healthcare needs involve a medication like Syfovre, determining if it’s covered by Medicare is a significant consideration. This will help you navigate the financial aspects of both your healthcare and your future home. Ultimately, carefully weighing these factors is key to making the right decision about mobile home rent-to-own arrangements.

is syfovre covered by medicare

The tax treatment of the rent-to-own transaction will be similar to a traditional rental, with the significant difference being the option to purchase the property.

Building Equity Through Rent-to-Own

A key advantage of rent-to-own is the opportunity to build equity in the property over time. As you make regular rent payments, a portion of those payments is often applied towards the purchase price, gradually increasing your ownership stake. This allows you to build equity while enjoying the stability of homeownership, and the equity built is an asset that can be leveraged in the future.

Comparison with Leasing

Rent-to-own differs significantly from traditional leasing. Leasing provides temporary occupancy with no ownership stake, whereas rent-to-own contracts offer the opportunity to become a homeowner. Rent-to-own enables you to build equity and potentially achieve homeownership. Leasing, on the other hand, typically does not involve equity accumulation and ends when the lease agreement expires.

Reasons for Choosing Rent-to-Own over Traditional Options

Many individuals choose rent-to-own over traditional financing due to factors like lower initial costs, faster closing times, and greater flexibility. This option is often more appealing to those with limited credit history or those who are not prepared to meet the rigorous requirements of a traditional mortgage. Another reason might be the desire to avoid high down payments or closing costs that can be substantial burdens.

Disadvantages of Mobile Home Rent-to-Own

Rent-to-own agreements, while offering an alternative path to homeownership, come with potential drawbacks that prospective buyers should carefully consider. Understanding these disadvantages is crucial for making an informed decision. These factors can significantly impact the overall financial picture and the long-term feasibility of the agreement.While rent-to-own arrangements can seem appealing, they often involve hidden costs and complexities that can lead to financial strain or disappointment.

Knowing these potential pitfalls can empower you to make a more strategic choice, ensuring you’re fully aware of the implications.

Potential Financial Risks

Rent-to-own agreements frequently involve higher upfront costs and more complex financing structures compared to traditional mortgages. These added complexities can sometimes lead to higher overall costs in the long run. This often translates to paying more than if you had simply purchased the home outright. Careful financial planning and a thorough understanding of the agreement’s terms are essential.

For instance, some agreements might include hefty down payments, and even hidden fees that can significantly impact your budget.

Limitations of Building Equity

Unlike traditional mortgages, rent-to-own arrangements often limit the accumulation of equity in the mobile home. This means that while you’re making payments, the equity you build is often significantly less than with a traditional mortgage. This is because the home’s title remains with the seller until the final purchase. Furthermore, your payments may not directly contribute to building the home’s value, making it challenging to achieve the same level of equity as with a traditional mortgage.

Consequently, the ownership transfer can be delayed due to various factors, and the value of the home may not necessarily reflect the payments made.

Higher Costs Over the Long Term

Rent-to-own agreements frequently have higher effective interest rates compared to traditional mortgage financing. This means that the total cost of the home, including interest and other fees, could be substantially greater over the life of the agreement. This increased cost can stem from the seller’s need to compensate for the risk involved in the rent-to-own arrangement. For example, a rent-to-own agreement might involve a higher interest rate, resulting in more significant interest payments in the long run.

Common Pitfalls of Rent-to-Own Agreements

One common pitfall is the difficulty in accurately predicting the final purchase price. The purchase price at the end of the agreement might be significantly different from the initial agreement. This can be due to market fluctuations or unexpected repairs. Additionally, the terms of the agreement, particularly regarding contingencies, might not be clearly defined, potentially creating future disputes or disagreements.

Failing to thoroughly review all aspects of the contract is another significant pitfall.

Common Legal Issues Associated with Rent-to-Own Contracts

Legal issues can arise if the rent-to-own agreement isn’t properly drafted or if either party fails to fulfill their obligations. Issues may stem from unclear language in the contract, lack of legal representation for either party, or disagreements about payment schedules or the final purchase price. Consequently, proper legal counsel is highly recommended for all parties involved. A detailed legal review is crucial to ensuring all terms are legally sound and that both parties understand their obligations.

It’s advisable to seek legal counsel before signing any rent-to-own agreement to clarify all aspects and ensure it’s a fair and mutually beneficial agreement.

The Mobile Home Rent-to-Own Market: Mobile Home Rent To Own

The mobile home rent-to-own market presents a unique opportunity for individuals seeking affordable housing options. It bridges the gap between traditional renting and homeownership, offering a flexible path to homeownership with various financial structures. Understanding the current state, driving factors, and future trends of this market is crucial for both potential buyers and investors.The mobile home rent-to-own market is experiencing dynamic changes, influenced by factors like economic fluctuations, interest rates, and evolving consumer preferences.

This sector is particularly sensitive to the broader economic climate, as affordability and accessibility remain central to its operation.

Current State of the Market

The current state of the mobile home rent-to-own market shows a diverse landscape, with varying levels of activity across different regions. Some areas are experiencing robust growth, driven by the appeal of affordable housing options and government incentives. Conversely, other regions face challenges due to limited inventory, increased competition, or stricter regulations.

Factors Influencing the Market

Several factors significantly influence the mobile home rent-to-own market. Economic conditions, including interest rates and inflation, play a pivotal role. High interest rates can make financing more expensive, impacting affordability. Conversely, stable or decreasing interest rates can stimulate demand and increase the market’s attractiveness. Supply and demand dynamics also heavily influence the market.

Limited availability of suitable mobile homes can drive up prices and rental rates, while increased demand can lead to greater competition among potential buyers. Government regulations and incentives also significantly shape the market.

Trends in the Market Over the Past Five Years

Over the past five years, the mobile home rent-to-own market has witnessed noticeable shifts. Increased awareness and consumer interest in this alternative housing model have contributed to a rise in demand. Simultaneously, technological advancements have streamlined the transaction process, making it more accessible to prospective buyers. The rise of online platforms has facilitated communication and the search for suitable properties.

Geographical Variations in the Rent-to-Own Market

The rent-to-own market for mobile homes displays notable geographical variations. For example, regions with high housing costs and limited inventory often experience a surge in rent-to-own activity. Conversely, areas with abundant affordable housing options may show less dynamic growth in this specific segment. Furthermore, state regulations and local zoning ordinances can significantly impact the availability and terms of rent-to-own contracts.

Key Players and Organizations

Numerous organizations and companies are key players in the mobile home rent-to-own sector. Mobile home parks and dealerships are frequently involved in rent-to-own programs. Financial institutions that specialize in financing mobile home purchases are also essential players. Furthermore, industry associations and advocacy groups play a critical role in shaping regulations and promoting fair practices.

Rent-to-Own Terms by Region (Illustrative Table)

| Region | Down Payment | Monthly Rent | Purchase Option Timeline | Interest Rates |

|---|---|---|---|---|

| California | $5,000-$10,000 | $1,000-$1,500 | 3-5 years | 4-6% |

| Florida | $3,000-$7,000 | $700-$1,200 | 2-4 years | 3-5% |

| Texas | $2,500-$6,000 | $600-$1,000 | 2-3 years | 4-6% |

Note: This table provides illustrative data. Actual terms may vary significantly based on individual contracts and local market conditions.

Legal Considerations

Navigating the legal landscape of mobile home rent-to-own agreements is crucial for both buyers and sellers. These contracts, while offering a pathway to homeownership, often involve complex legal intricacies. Understanding the rights and responsibilities Artikeld in these agreements is paramount to avoiding potential disputes. Thorough knowledge of applicable laws and regulations, coupled with professional legal counsel, can significantly reduce the risk of costly and time-consuming legal battles.Comprehending the legal framework surrounding mobile home rent-to-own agreements is vital.

This involves understanding the specific rights and obligations of both parties, the potential pitfalls of such contracts, and the importance of legal advice. Knowing how to mitigate common legal issues and what to expect in different jurisdictions is critical for a smooth and successful transaction.

Rights and Responsibilities of Renters

Renters have specific rights and responsibilities within a rent-to-own agreement. These rights are often Artikeld in the contract and vary based on local regulations. A fundamental right is the right to reside in the property and utilize the facilities as per the terms Artikeld in the agreement. Additionally, renters are generally responsible for maintaining the property according to the agreed-upon standards.

This includes adhering to any specific maintenance schedules or repair obligations Artikeld in the contract. Furthermore, they are obligated to make timely rental payments, adhere to the rules and regulations Artikeld in the contract, and refrain from actions that would violate the terms of the agreement.

Rights and Responsibilities of Owners

Owners, on the other hand, also have specific rights and responsibilities. They are obligated to provide a safe and habitable living environment as per local building codes and health regulations. Owners are responsible for fulfilling the terms of the contract, including ensuring the accuracy of any disclosures related to the property’s condition. Moreover, owners must address any necessary repairs or maintenance issues as per the terms of the agreement.

This responsibility is often contingent on the renter’s maintenance obligations. It’s crucial for owners to understand and adhere to local laws and regulations regarding rent-to-own agreements.

Common Legal Disputes

Disputes in rent-to-own agreements frequently arise from differing interpretations of contract terms, disagreements regarding repairs, or missed payment deadlines. A common dispute centers on the accuracy of property disclosures. Discrepancies between the stated condition of the mobile home and the actual condition can lead to significant legal issues. Furthermore, disputes over late payments, or failure to comply with the terms of the agreement, can escalate into legal challenges.

Importance of Legal Consultation

Consulting with a qualified attorney specializing in real estate or mobile home transactions is highly recommended before entering into a rent-to-own agreement. Legal counsel can provide valuable insights into the specifics of the agreement, helping to clarify potential risks and liabilities. They can also assist in drafting a fair and comprehensive contract that protects both parties’ interests. An attorney can thoroughly review the contract to identify any ambiguities or potential issues.

Legal Implications by Jurisdiction

| Jurisdiction | Key Legal Considerations |

|---|---|

| State A | Specific laws regarding mobile home parks and rental agreements apply. Stricter rules regarding disclosure of property defects may be in place. |

| State B | Regulations on rent-to-own agreements may differ significantly from those in State A. Specific provisions regarding the duration of the agreement and payment schedules might be more stringent. |

| State C | Local ordinances and regulations regarding mobile home ownership and renting may have a direct impact on the agreement’s terms. |

This table provides a basic comparison. It is imperative to consult legal counsel familiar with the specific jurisdiction for a complete and accurate understanding of the legal implications.

Avoiding Common Legal Issues, Mobile home rent to own

Carefully reviewing all terms of the rent-to-own agreement is essential. Understanding the payment schedule, the duration of the agreement, and any specific maintenance obligations is critical. It is vital to clearly document all verbal agreements in writing. A written agreement minimizes misunderstandings and provides a clear record of the terms of the agreement. Seeking legal counsel to review the contract before signing it is a prudent measure.

Thorough documentation of all communications and transactions can also prove invaluable in case of disputes.

Finding Mobile Home Rent-to-Own Opportunities

Unlocking the dream of homeownership through rent-to-own mobile homes requires a strategic approach. This journey involves diligent research, careful evaluation, and a thorough understanding of the market. Navigating the complexities of rent-to-own agreements demands a proactive mindset and a keen eye for detail. With the right tools and knowledge, you can confidently embark on this exciting path.Finding the perfect rent-to-own mobile home requires a proactive approach, combining online resources with local networking.

Success hinges on identifying trustworthy sellers and evaluating various properties based on your needs and budget.

Identifying Potential Opportunities

Locating rent-to-own mobile home listings involves leveraging a variety of online platforms. These platforms can provide a broad overview of available properties, often including details such as location, price, and amenities. A proactive approach includes exploring classifieds, real estate portals, and mobile home-specific websites. This comprehensive search strategy increases your chances of finding a suitable option.

Online Resources for Finding Rent-to-Own Mobile Homes

Numerous online resources provide listings for mobile home rent-to-own opportunities. These platforms often include detailed property descriptions, enabling a thorough evaluation of available options. Popular real estate websites, specialized mobile home marketplaces, and social media groups dedicated to mobile home communities can be valuable tools. For instance, sites like Craigslist, Facebook Marketplace, and specialized mobile home forums can often yield promising leads.

Be sure to thoroughly vet any source before relying on its information.

Criteria for Evaluating Rent-to-Own Options

A critical aspect of the rent-to-own process is evaluating the viability of each potential option. Consider key factors such as the property’s location, price, and amenities to ensure it aligns with your financial goals and lifestyle. Factors like proximity to work, schools, and essential services should also be carefully considered. This approach will help you make informed decisions and minimize potential risks.

Comparing Rent-to-Own Properties

The table below demonstrates a structured approach to comparing different mobile home rent-to-own options. This table highlights essential details like location, price, and available amenities.

| Property | Location | Price (per month) | Amenities | Other Notes |

|---|---|---|---|---|

| Property A | Rural area, near a lake | $800 | Basic kitchen, bathroom, and living area; small yard | Needs minor repairs |

| Property B | Suburban area, close to shopping | $950 | Modern kitchen, two bedrooms, large yard, covered porch | Well-maintained |

| Property C | Urban area, near public transportation | $750 | Basic amenities, shared laundry facilities | Part of a small community |

Due Diligence on Potential Properties

Thorough due diligence is crucial in the rent-to-own process. Inspect the property meticulously, checking for any signs of damage or potential maintenance issues. A pre-purchase inspection is highly recommended to identify any hidden problems and to assess the condition of the mobile home and its foundation. This proactive step can help mitigate potential risks and ensure a smooth transaction.

Best Practices for Navigating the Rent-to-Own Process

When navigating the rent-to-own process, prioritize clear communication and a thorough understanding of the agreement. Seek professional advice from a real estate agent or legal professional to ensure the contract protects your interests. Document every detail of the agreement, including the purchase price, down payment, and payment schedule. This proactive approach will minimize potential conflicts and ensure a positive outcome.

Practical Considerations for Rent-to-Own

Navigating the world of mobile home rent-to-own requires careful attention to practical details. Understanding responsibilities, repair processes, insurance needs, and budgeting strategies is crucial for a smooth and successful experience. This section provides a comprehensive overview of these essential elements, ensuring you’re well-equipped to make informed decisions.

Maintenance Responsibilities

Proper maintenance is vital for preserving the value of your mobile home and ensuring its longevity. Clearly defined responsibilities between the renter and owner prevent misunderstandings and ensure the home’s upkeep.

Mobile home rent-to-own offers a unique path to homeownership, but careful consideration of financing is key. A significant aspect of securing a future in a mobile home is understanding the associated costs, like potential maintenance and ongoing fees. If you’re seeking aesthetic enhancements, exploring options like plastic surgery san ramon ca could also be a financial consideration, depending on your budget.

Ultimately, successful mobile home rent-to-own requires careful planning and budgeting.

| Responsibility | Renter | Owner |

|---|---|---|

| Routine Maintenance (e.g., lawn care, exterior cleaning, minor plumbing repairs) | Yes | No |

| Major Repairs (e.g., HVAC system replacement, roof repairs, significant plumbing issues) | No | Yes |

| Preventive Maintenance (e.g., regular inspections, addressing minor issues promptly) | Yes | Yes |

This table Artikels typical maintenance responsibilities. Specific agreements should be detailed in the rent-to-own contract. It’s essential to clarify these roles early on to avoid disputes later.

Repair and Maintenance Procedures

Establishing a clear procedure for handling repairs and maintenance issues is critical. This ensures that problems are addressed efficiently and effectively.

A well-defined protocol for repairs is key to avoiding disputes.

The rent-to-own contract should specify who is responsible for initiating repairs, obtaining quotes, and approving work. Always document all communication and repairs undertaken. For example, a detailed log of repairs and maintenance with dates, descriptions, and the names of contractors is recommended.

Insurance Considerations

Insurance protection is essential for mobile home rent-to-own situations. The renter and owner should understand the insurance requirements and their individual responsibilities.

Renter’s insurance should protect personal belongings within the mobile home, while the owner’s insurance should cover the structure.

The renter should obtain renters insurance to cover their personal possessions. The owner should have adequate insurance for the mobile home structure. Ensure the policies are reviewed and updated to reflect the specific details of the rent-to-own agreement.

Budgeting for Rent-to-Own Payments

Creating a comprehensive budget is crucial for managing mobile home rent-to-own payments. This budget should factor in all potential expenses associated with the mobile home, including utilities, maintenance, and property taxes.For example, consider allocating a portion of your monthly budget specifically for potential repairs or unexpected maintenance costs. A contingency fund can help absorb these expenses and avoid financial strain.

Detailed budgeting and meticulous record-keeping are essential.

Dispute Resolution Strategies

Disputes can arise in any rent-to-own agreement. Having strategies in place for conflict resolution can help avoid escalation.Effective communication and adherence to the terms Artikeld in the contract are vital. A written record of all communications is crucial. If a dispute arises, consider mediation or arbitration as less costly alternatives to court.

Defaulting on the Rent-to-Own Contract

Understanding the implications of defaulting on a rent-to-own contract is critical. Understanding the steps involved in this process is crucial for making informed decisions.Before considering defaulting, thoroughly review the contract and understand the consequences of non-compliance. Contact the seller to discuss possible solutions or renegotiation options. Consult with legal counsel to understand your rights and responsibilities. Thorough consideration of all options is crucial.

Defaulting should be a last resort.

Illustrative Examples

Unlocking the exciting world of mobile home rent-to-own requires understanding practical applications. This section delves into real-life examples, providing a clearer picture of how these agreements function, highlighting potential pitfalls, and showcasing successful transactions. This practical insight will empower you to make informed decisions.

Sample Rent-to-Own Agreement

A sample rent-to-own agreement Artikels the key terms and conditions of the transaction. Crucially, it specifies the purchase price, the down payment (if any), the monthly rent amount, the length of the rental period, the interest rate (if applicable), and the conditions for eventual ownership. It also details the process for applying for the loan after the rental period.

This legal document ensures both parties are on the same page regarding their responsibilities and rights. Clear and comprehensive terms and conditions are vital for avoiding future disputes.

Successful Transaction Case Study

A successful mobile home rent-to-own transaction often involves careful consideration of financial stability and a strong understanding of the agreement’s terms. For instance, Sarah, a first-time homebuyer, found a suitable mobile home through a reputable rent-to-own program. She diligently managed her finances, ensuring consistent rental payments and adhering to all the agreement’s terms. After a predetermined period, she successfully secured a loan and became the owner of the mobile home.

This demonstrates the potential for success with meticulous planning and responsible financial management.

Typical Rent-to-Own Timeline

The timeline for a typical rent-to-own agreement varies based on the specific agreement. Generally, it begins with the initial agreement and includes the rental period. During this time, the renter accumulates equity. Upon fulfilling the rental obligations, the renter may be eligible to apply for a loan to purchase the home. The timeframe can range from several months to a few years.

Infographic: Costs Associated with Rent-to-Own

A detailed infographic illustrating the costs associated with a mobile home rent-to-own agreement should clearly display the rental payments, potential down payments, closing costs (which can include appraisal fees, title insurance, and recording fees), and any additional fees. It should also highlight the potential savings compared to purchasing a home outright. Visual representation is crucial to understand the financial implications and make informed decisions.

This infographic should also indicate the total estimated cost of the transaction over the rental period.

Rent-to-Own Contract Terms and Conditions Breakdown

A comprehensive breakdown of a rent-to-own contract’s terms and conditions will specify the total purchase price, the monthly rental payment amount, the length of the agreement, the interest rate (if any), the process for obtaining financing to buy the home after the rental period, and any penalties for defaulting on payments. The contract should Artikel the responsibilities of both the renter and the owner.

Furthermore, it should clearly explain the process of becoming the owner after the rental period, outlining the conditions required.

Scenario of a Rent-to-Own Agreement Going Wrong

A rent-to-own agreement can go wrong if either party fails to fulfill their obligations. For instance, if the renter consistently misses payments, the agreement might be terminated. Similarly, if the owner fails to comply with the agreed-upon terms, the renter could face issues. Furthermore, unforeseen circumstances such as job loss or significant financial setbacks can also lead to difficulties in maintaining the agreement.

Careful financial planning, understanding of terms, and responsible management are key to a successful transaction.

Last Recap

In conclusion, mobile home rent-to-own presents a compelling pathway to homeownership, blending the familiarity of a rental agreement with the eventual ownership goal. This guide has illuminated the various facets of this model, revealing both the exciting possibilities and the inherent complexities. By understanding the advantages, disadvantages, market trends, legal considerations, and practical steps involved, you’ll be better prepared to make informed decisions in your search for a suitable mobile home rent-to-own opportunity.

Remember, thorough research and careful planning are key to a successful and satisfying experience.

Answers to Common Questions

What are the common payment terms in a mobile home rent-to-own agreement?

Payment terms vary widely, but generally involve a combination of monthly rent payments and a portion of the payments going towards the eventual purchase price. Contracts often Artikel a specific timeframe for accumulating enough funds to purchase the home.

What are the key differences between a mobile home rent-to-own agreement and a lease?

A rent-to-own agreement carries the potential for eventual ownership, while a lease does not. A lease is a temporary agreement to rent, while a rent-to-own agreement is designed to eventually transition to a purchase agreement.

What are some common legal issues associated with mobile home rent-to-own contracts?

Common legal issues include unclear contract language, disputes over maintenance responsibilities, and disputes over the purchase price at the end of the agreement. Consulting with a legal professional is highly recommended.

How can I find reputable mobile home rent-to-own opportunities?

Start by researching online resources and local real estate listings. Look for reputable sellers with a proven track record. Be wary of unusual or overly-promising deals. Thorough due diligence is essential.